Delving into the realm of life insurance for individuals over 50, this article sheds light on the unique needs and considerations that come into play at this stage of life.

Exploring the various facets of life insurance tailored for the over 50s demographic, we uncover the nuances that make this type of coverage essential.

Why Life Insurance is Important for Over 50s

Life insurance becomes increasingly important for individuals over 50 as they enter a stage of life where financial responsibilities are greater and retirement planning is crucial. It serves as a safety net to protect loved ones and assets in the event of unexpected circumstances.

Significance of Life Insurance for Over 50s

Life insurance provides financial security and peace of mind for individuals over 50, ensuring that their dependents are taken care of in case of their untimely demise. This age group often has outstanding mortgages, debts, and other financial obligations that need to be covered even after they are gone.

- Research shows that over 50s are more likely to have dependents, such as children or aging parents, who rely on their financial support. Life insurance can guarantee that these dependents are provided for in the absence of the policyholder.

- Statistics indicate that the cost of funerals and end-of-life expenses is on the rise, making it essential for individuals over 50 to have adequate life insurance coverage to alleviate the financial burden on their loved ones.

- Moreover, life insurance can also be used as an inheritance tool to pass on wealth to beneficiaries tax-free, ensuring a smooth transfer of assets and financial stability for future generations.

Potential Risks of Not Having Adequate Life Insurance Coverage

Not having sufficient life insurance coverage can lead to dire consequences for individuals over 50 and their families. Without a proper policy in place, they may face the following risks:

- Financial instability for dependents, who may struggle to maintain their standard of living or pay off debts left behind by the deceased.

- Forcing loved ones to make difficult decisions or sacrifices to cover funeral expenses and outstanding debts, adding emotional stress to an already challenging time.

- Lack of inheritance planning, which could result in assets being tied up in probate or distributed in a manner that does not align with the policyholder's wishes.

Types of Life Insurance Suitable for Over 50s

When it comes to life insurance for individuals over 50, there are several options to consider. Each type of policy has its own features and benefits, making it important to understand the differences to choose the right one for your needs.

Whole Life Insurance

Whole life insurance is a permanent policy that provides coverage for the entire lifetime of the insured. It offers a guaranteed death benefit, level premiums, and a cash value component that grows over time. For individuals over 50, whole life insurance can be a good option for those looking for lifelong coverage with a savings component.

Term Life Insurance

Term life insurance, on the other hand, provides coverage for a specific period, usually 10, 20, or 30 years. It offers a death benefit but does not accumulate cash value. Term life insurance is typically more affordable than whole life insurance, making it a suitable choice for those looking for coverage for a specific period or for a lower premium.

Universal Life Insurance

Universal life insurance is a flexible policy that combines the benefits of permanent coverage with an investment component. It allows policyholders to adjust their premiums and death benefits over time. While universal life insurance can offer more flexibility, it may come with higher fees and risks compared to other types of policies.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a type of policy that does not require a medical exam or health questionnaire for approval. It is typically more expensive and offers lower coverage amounts than other types of life insurance. Guaranteed issue life insurance can be a good option for individuals over 50 who have health issues or difficulty obtaining coverage elsewhere.

Factors to Consider When Choosing Life Insurance After 50

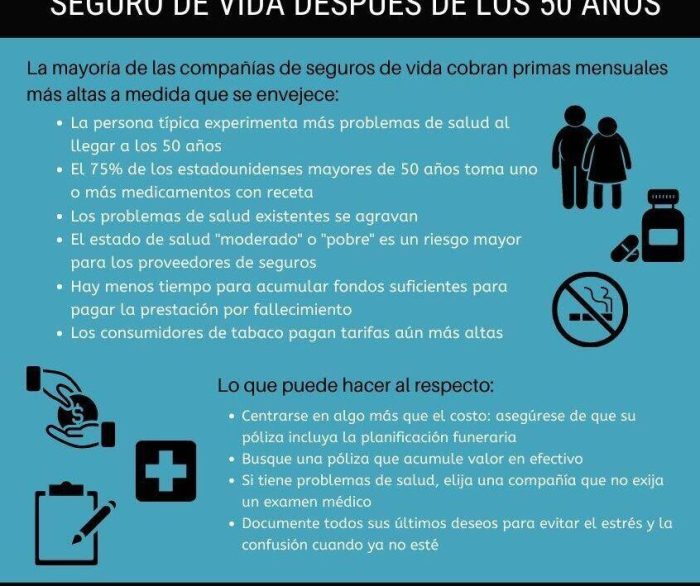

When individuals reach the age of 50, selecting the right life insurance policy becomes crucial. Several key factors need to be taken into consideration to ensure that the chosen coverage meets their specific needs and circumstances.

Health Status

It is essential for individuals over 50 to assess their current health status before choosing a life insurance policy. Factors such as pre-existing medical conditions, lifestyle habits, and overall health can impact the type of coverage available and the premium rates.

Financial Situation

When selecting life insurance after 50, it is important to evaluate one's financial situation carefully. Considerations should include existing debts, mortgage payments, retirement savings, and any other financial obligations that may affect the amount of coverage needed to provide financial security for dependents.

Dependents

Another crucial factor to consider is the number of dependents relying on the individual for financial support. Whether it is a spouse, children, or aging parents, determining the level of financial protection required to secure their future in the event of the policyholder's passing is essential.

Determining the Appropriate Coverage Amount

To determine the right coverage amount, individuals over 50 can calculate their financial obligations, such as outstanding debts, future expenses, and income replacement needs. It is advisable to consult with a financial advisor to assess these factors accurately and choose a policy that aligns with their specific requirements.

Considering Inflation, Medical Expenses, and Funeral Costs

When selecting life insurance after 50, it is crucial to account for inflation, rising medical expenses, and the cost of funeral arrangements. Adjusting the coverage amount to accommodate these factors ensures that the policy remains relevant and provides adequate financial protection for beneficiaries.

Benefits of Purchasing Life Insurance After 50

Life insurance is a valuable financial tool that provides security and peace of mind, especially for individuals over the age of

50. Here are some key benefits of purchasing life insurance later in life

Financial Security for Outstanding Debts

Life insurance can help cover any outstanding debts that may be left behind, such as mortgages, car loans, or credit card balances. By having a life insurance policy in place, your loved ones won't be burdened with these financial obligations after your passing.

Estate Planning and Asset Protection

Life insurance plays a crucial role in estate planning by ensuring that your assets are protected and distributed according to your wishes. It can help cover estate taxes and other expenses, allowing for a smooth transfer of wealth to your beneficiaries.

Leaving a Legacy for Loved Ones

One of the most significant benefits of life insurance is the ability to leave a financial legacy for your loved ones. Whether it's providing for your children's education, supporting a charitable cause, or ensuring your spouse's financial security, life insurance allows you to leave a lasting impact even after you're gone.

Real-Life Examples

Consider the case of John, a 55-year-old father of two who unexpectedly passed away. Thanks to his life insurance policy, his family was able to pay off the mortgage on their home and cover their living expenses without worrying about financial strain.

This real-life example showcases how life insurance can provide much-needed financial security and support during difficult times.

Closing Notes

Wrapping up our discussion on why over 50s need a different kind of life insurance, it's evident that securing the right policy is crucial for financial stability and peace of mind in the golden years.

Question Bank

What are the key factors to consider when choosing life insurance after 50?

Factors such as health status, financial situation, and dependents play a crucial role in determining the most suitable coverage for individuals over 50.

How can life insurance benefit individuals over 50?

Life insurance provides financial security, helps cover outstanding debts, assists in estate planning, and allows for leaving a legacy for loved ones.

What types of life insurance are suitable for individuals over 50?

Whole life insurance, term life insurance, universal life insurance, and guaranteed issue life insurance are some options to consider for those over 50.