Exploring the crucial need for liability insurance among service providers sheds light on the vital role it plays in safeguarding businesses. From unforeseen circumstances to legal protection, delve into the world of liability insurance and its impact on service providers.

Importance of Liability Insurance

Liability insurance is crucial for service providers as it offers protection against financial losses resulting from legal claims brought against them for property damage or bodily injuries.

Protection from Lawsuits

Having liability insurance can shield service providers from expensive lawsuits that may arise from accidents, mistakes, or negligence during the course of providing services. For example, a customer slipping and falling in a salon due to a wet floor can result in a costly lawsuit for the business owner.

Professional Indemnity

Liability insurance also provides professional indemnity coverage, which is essential for service providers like accountants, consultants, or healthcare professionals. In case a client suffers financial losses due to errors or omissions in the services provided, the insurance can cover the damages.

Property Damage Coverage

Another critical aspect of liability insurance is property damage coverage. Service providers working in clients' homes or offices may accidentally damage property during the service delivery. Without insurance, the cost of repairs or replacements could be financially devastating.

Consequences of Not Having Liability Insurance

Service providers who do not have liability insurance risk facing severe financial consequences in case of lawsuits or claims. They may have to pay for legal fees, settlements, or damages out of pocket, leading to financial strain and potential bankruptcy.

Types of Liability Insurance

When it comes to protecting service providers from potential risks and liabilities, different types of liability insurance play a crucial role. Understanding the distinctions between general liability, professional liability, and product liability insurance is essential for service providers to ensure they have the right coverage in place.

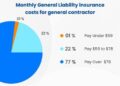

General Liability Insurance

General liability insurance provides coverage for claims of bodily injury, property damage, and personal injury that may arise during the course of business operations. For service providers, this type of insurance can protect against lawsuits related to accidents or injuries that occur on their premises or as a result of their services.

For example, if a customer slips and falls while receiving a service, general liability insurance can help cover legal expenses and potential settlements.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is designed to protect service providers from claims of negligence or inadequate work performance. This type of insurance is particularly important for service providers who offer advice, consultancy, or professional services.

For instance, if a client claims financial losses due to professional advice provided by a service provider, professional liability insurance can help cover legal fees and damages.

Product Liability Insurance

Product liability insurance is crucial for service providers who sell or distribute products to customers. This type of insurance provides coverage for claims of injury or property damage caused by a defective product. For example, if a customer suffers harm from using a product sold by a service provider, product liability insurance can help cover legal expenses and compensation.

Coverage Limits and Considerations

When it comes to liability insurance, coverage limits play a crucial role in determining the extent of financial protection a service provider has in case of a claim or lawsuit. These limits define the maximum amount an insurance policy will pay out for covered claims, making it essential for service providers to carefully consider their coverage limits to ensure adequate protection.

Factors to Consider When Determining Coverage Limits

- Nature of Services: Service providers offering high-risk services may require higher coverage limits to protect against potential large claims.

- Industry Standards: It is important to align coverage limits with industry standards to ensure adequate protection in case of lawsuits or claims.

- Business Size: Larger businesses may require higher coverage limits to account for the scale of their operations and potential risks.

- Assets at Risk: Service providers should assess the value of their assets at risk and choose coverage limits that can adequately protect their financial interests.

Assessing Liability Risks for Setting Coverage Limits

- Conduct Risk Assessment: Service providers should evaluate potential risks associated with their operations, including injury or property damage, to determine appropriate coverage limits.

- Consult with Insurance Professionals: Seeking guidance from insurance professionals can help service providers understand their liability risks and choose coverage limits that offer comprehensive protection.

- Review Past Claims: Analyzing past claims can provide insights into the types of risks faced by the business and help in setting appropriate coverage limits for future protection.

Legal Requirements and Regulations

In the context of liability insurance for service providers, there are specific legal requirements and regulations that must be adhered to. Failure to comply with these legal obligations can have serious consequences for service providers, affecting their ability to operate legally and potentially exposing them to significant financial risks.

Implications of Non-Compliance

Failure to comply with legal requirements regarding liability insurance can result in fines, penalties, and even the suspension or revocation of licenses for service providers. In addition, non-compliance may lead to legal action by clients or third parties in the event of accidents or incidents, leaving the service provider personally liable for damages.

Examples of Legal Cases

- In a case where a construction company did not have the required liability insurance coverage, a worker was injured on the job. The injured worker sued the company for negligence, leading to significant legal costs and a hefty settlement that the company had to pay out of pocket.

- Another example involves a healthcare provider who failed to maintain adequate liability insurance. When a patient suffered harm due to medical malpractice, the provider faced a lawsuit that resulted in a substantial financial settlement, causing reputational damage and financial strain on the business.

Last Word

In conclusion, the significance of liability insurance for service providers cannot be overstated. As a fundamental aspect of risk management, having the right coverage can make all the difference in the face of unexpected challenges. Stay informed, stay protected, and ensure the longevity of your service-based business with reliable liability insurance.

FAQ Compilation

What does liability insurance cover?

Liability insurance typically covers legal costs, settlements, and judgments that arise from claims of negligence or harm caused by the service provider.

Is liability insurance mandatory for service providers?

While it may not be a legal requirement in all cases, having liability insurance is highly recommended to protect your business from potential financial risks.

How can service providers determine the right coverage limits?

Service providers should consider factors like the nature of their services, potential risks involved, and the financial impact of a claim when determining their coverage limits.