Embark on a journey through the realm of car insurance quotes by state with our comprehensive guide for 2025. Discover the nuances of comparing rates, the impact of technology, and future predictions in this dynamic industry.

Overview of Car Insurance Quotes by State in 2025

When shopping for car insurance, it's essential to compare quotes by state to ensure you're getting the best coverage at the most competitive rates. Each state has its own regulations, driving conditions, and risk factors that can significantly impact insurance premiums.

Importance of Comparing Car Insurance Quotes by State

It's crucial to compare car insurance quotes by state because rates can vary widely depending on where you live. Factors such as population density, weather conditions, crime rates, and state-specific laws all play a role in determining insurance premiums.

How Car Insurance Rates Vary from State to State

- Population Density: States with higher population density tend to have more traffic congestion and a higher likelihood of accidents, leading to higher insurance rates.

- Weather Conditions: States prone to severe weather events like hurricanes or snowstorms may have higher insurance rates to account for potential damage to vehicles.

- Crime Rates: Areas with higher crime rates may experience more theft or vandalism, resulting in increased insurance premiums.

- State Laws: Each state has its own regulations governing insurance requirements and coverage options, which can impact rates.

Factors that Influence Car Insurance Quotes by State

-

Driving History: Your driving record, including accidents and traffic violations, can impact your insurance rates.

-

Age and Gender: Younger drivers and males typically pay higher insurance rates due to higher risk factors.

-

Vehicle Type: The make and model of your car, as well as its safety features, can affect insurance prices.

-

Credit Score: In some states, your credit score can influence your insurance premiums.

Trends in Car Insurance Industry by State for 2025

As we look ahead to 2025, several trends are shaping the car insurance industry in different states. From technological advancements to regulatory changes, the landscape of car insurance quotes is evolving rapidly.

Emerging Trends in Car Insurance Industry

- Usage-based insurance policies are becoming more popular, allowing drivers to pay premiums based on their actual driving habits.

- Personalized insurance plans are on the rise, with insurers leveraging data analytics to tailor coverage options to individual needs.

- Integration of AI and machine learning technologies is streamlining the claims process and improving customer experience.

Impact of Technology on Availability of Car Insurance Quotes

Technology is revolutionizing the way car insurance quotes are generated and offered in various states. Online platforms and mobile apps now allow consumers to compare quotes from multiple insurers conveniently and quickly.

Regulatory Changes Affecting Car Insurance Quotes

- Several states are implementing stricter regulations on insurance pricing to ensure fairness and transparency for consumers.

- The introduction of new laws governing autonomous vehicles is prompting insurers to adjust their coverage options and premiums accordingly.

- Regulatory bodies are focusing on promoting competition in the insurance market to provide consumers with more choices and affordable rates.

Comparison of Car Insurance Quotes Across States

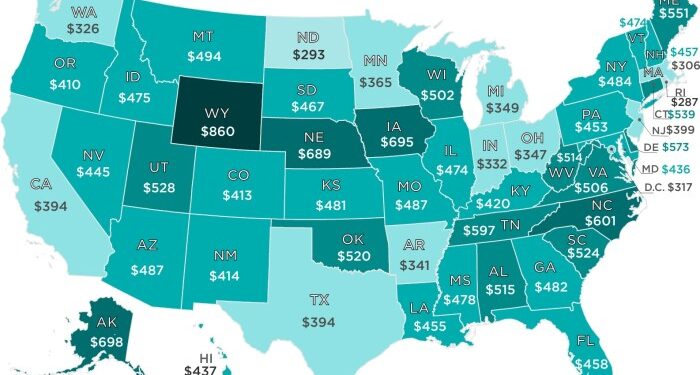

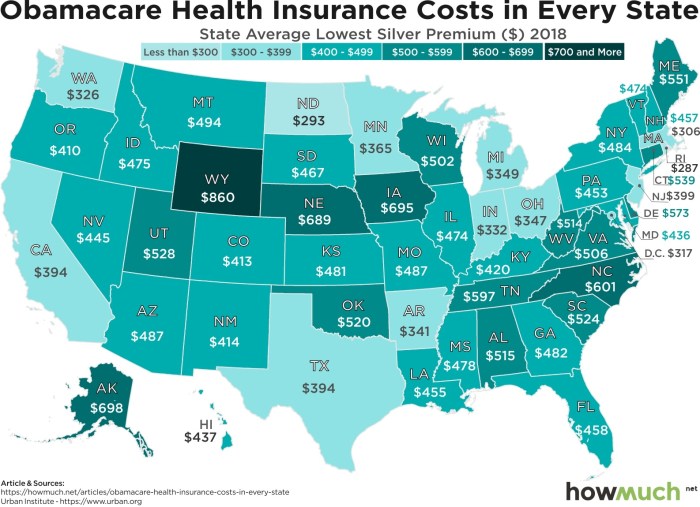

When comparing car insurance quotes across different states in 2025, it is essential to understand the factors that contribute to the variations in rates and coverage options based on your location.The average car insurance rates can vary significantly from state to state due to several reasons, including:

Factors Influencing Car Insurance Rates

- State Regulations: Each state has its own set of regulations governing car insurance, which can impact the rates insurers offer.

- Population Density: States with higher population densities may experience more accidents, leading to higher insurance premiums.

- Weather Conditions: States prone to severe weather conditions may have higher rates due to increased risk of damage.

- Crime Rates: Areas with higher crime rates may have higher rates to cover the risk of theft or vandalism.

Differences in Coverage Options

- Minimum Coverage Requirements: Each state sets its own minimum coverage requirements, which can affect the cost of insurance.

- Optional Coverage: Some states offer additional optional coverage options that can impact the overall cost of insurance.

- Uninsured Motorist Coverage: Requirements for uninsured motorist coverage can vary by state, affecting rates and coverage options.

By understanding these factors and how they contribute to the variations in car insurance rates and coverage options across states, you can make informed decisions when shopping for car insurance in 2025.

Future Predictions for Car Insurance Quotes by State

As we look ahead to 2030, the landscape of car insurance quotes by state is expected to undergo significant changes due to various factors. Let's explore some potential predictions and trends that could shape the future of car insurance rates across different states.

Potential Impact of Autonomous Vehicles on Car Insurance Rates by State

With the rise of autonomous vehicles, it is anticipated that car insurance rates will be influenced by the shift in liability from human drivers to manufacturers or technology providers. States that embrace autonomous vehicles may see a decrease in accidents and claims, leading to lower insurance premiums.

However, the cost of insuring advanced technology in these vehicles could also impact rates.

Climate Change and its Influence on Car Insurance Costs in Various States

Climate change is expected to have a significant impact on car insurance costs in different states. States prone to severe weather events such as hurricanes, wildfires, or flooding may experience an increase in insurance premiums due to higher risks of vehicle damage.

Additionally, the frequency and severity of natural disasters caused by climate change could lead to more claims and drive up insurance costs.

Closure

As we conclude our exploration of Shop Car Insurance Quotes by State: 2025 Guide, we hope you've gained valuable insights into the world of insurance rates. Stay informed, stay protected, and drive safely on the roads ahead.

Quick FAQs

How do car insurance rates vary by state?

Car insurance rates vary by state due to factors like population density, crime rates, and weather conditions.

What are the emerging trends in the car insurance industry for 2025?

In 2025, emerging trends include usage-based insurance, AI-driven claims processing, and personalized coverage options.

Will autonomous vehicles impact car insurance rates by state?

Autonomous vehicles could potentially lower insurance rates by reducing accidents caused by human error.

How might climate change influence car insurance costs in different states?

Climate change could lead to increased risks like flooding or wildfires, affecting insurance costs in vulnerable areas.