Embark on a journey to discover the smartest way to shop for car insurance quotes. From understanding the importance of comparison to customizing quotes to fit your needs, this guide will equip you with the knowledge to make informed decisions.

Importance of Shopping Car Insurance Quotes

When it comes to car insurance, shopping around for quotes is crucial for finding the best coverage at the most competitive rates. By comparing car insurance quotes, you can save money, tailor your coverage to fit your needs, and ensure you are getting the best value for your money.

Save Money

Shopping car insurance quotes allows you to find the most affordable rates available in the market. Different insurance providers offer varying rates based on factors such as your driving record, age, location, and type of vehicle. By comparing quotes, you can identify the best deal and potentially save hundreds of dollars each year.

Understand Different Coverage Options

Each car insurance policy offers different coverage options and levels of protection. By shopping around and comparing quotes, you can understand the various coverage options available to you, such as liability coverage, collision coverage, comprehensive coverage, and more. This knowledge empowers you to make an informed decision that meets your specific needs.

Factors to Consider When Comparing Quotes

When comparing car insurance quotes, it's essential to pay attention to several key factors that can greatly impact your decision. Understanding how these factors influence the cost of your insurance can help you make an informed choice that suits your needs and budget.

Type of Coverage

The type of coverage you choose has a significant impact on the cost of your car insurance. Basic liability coverage is usually the most affordable option, as it only covers damages to the other party in an accident. On the other hand, comprehensive coverage, which includes protection for your own vehicle as well, tends to be more expensive.

Consider your specific needs and the level of protection you require when comparing quotes.

Deductibles and Premiums

Deductibles and premiums are crucial components of car insurance quotes that can affect the overall cost. Deductibles refer to the amount you must pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but it also means you'll have to pay more in case of an accident.

On the other hand, lower deductibles lead to higher premiums but provide more financial protection when you need to file a claim. It's important to strike a balance between deductibles and premiums based on your financial situation and risk tolerance.

Researching Insurance Companies

Before getting car insurance quotes, it's crucial to research insurance companies to ensure you're choosing a reliable provider. Here are some tips to help you make an informed decision:

Checking Customer Reviews and Ratings

When researching insurance companies, take the time to read customer reviews and ratings. This feedback can give you valuable insights into the quality of service, claims process efficiency, and overall customer satisfaction.

- Look for patterns in reviews to see if there are common complaints or praises about the company.

- Check independent review websites and forums for unbiased opinions from real customers.

Verifying Financial Stability of Insurance Providers

Another essential aspect to consider is the financial stability of insurance companies. You want to ensure that your chosen provider can fulfill its financial obligations, especially when it comes to paying out claims.

- Research the financial ratings of insurance companies from reputable agencies like A.M. Best, Standard & Poor's, or Moody's.

- Look for the company's financial strength rating, which indicates its ability to meet policyholder obligations.

- Check the company's track record of handling claims and its history of financial stability in the industry.

Using Online Tools and Resources

Online tools play a crucial role in helping individuals compare car insurance quotes efficiently. These tools provide a convenient way to gather multiple quotes from various insurance companies, saving time and effort in the process.

Advantages of Using Comparison Websites or Apps

- Comparison websites or apps offer a centralized platform to input your information once and receive multiple quotes from different insurers.

- These platforms allow you to easily compare coverage options, deductibles, and premiums side by side, helping you make an informed decision.

- By using these tools, you can potentially save money by finding the best deal that suits your budget and coverage needs.

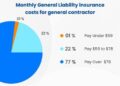

Tips on Utilizing Calculators to Estimate Insurance Costs

- Insurance calculators are valuable tools that can provide an estimate of your insurance costs based on factors such as your age, location, driving history, and type of vehicle.

- When using calculators, make sure to input accurate information to receive the most precise estimate possible.

- Consider using multiple calculators from different sources to compare results and ensure you have a comprehensive understanding of the potential costs.

Customizing Quotes to Fit Your Needs

When shopping for car insurance, it's important to customize your quotes to fit your specific needs. This involves adjusting coverage limits, deductibles, and including add-ons or discounts that cater to your individual circumstances.

Adjusting Coverage Limits and Deductibles

One way to customize your car insurance quote is by adjusting the coverage limits and deductibles. Coverage limits refer to the maximum amount your insurance company will pay for a covered claim, while deductibles are the out-of-pocket amount you must pay before your insurance kicks in.

By increasing or decreasing these limits, you can tailor your policy to better suit your budget and coverage requirements.

Including Specific Add-Ons or Discounts

Another aspect of customizing your car insurance quote is including specific add-ons or discounts. Add-ons, such as roadside assistance or rental car coverage, can provide extra protection and convenience. Discounts, on the other hand, can help you save money on your premiums.

Common discounts include safe driver discounts, multi-policy discounts, and good student discounts. Make sure to inquire about these options when comparing quotes to ensure you're getting the best deal possible.

Seeking Discounts and Bundling Options

When shopping for car insurance, it's essential to explore the various discounts and bundling options offered by insurance companies. These can help you save money while still getting the coverage you need.

Common Discounts Available

- Multi-policy discount: When you insure both your home and auto with the same insurance company, you can often receive a discount on both policies.

- Safe driver discount: If you have a clean driving record with no accidents or violations, you may qualify for a safe driver discount.

- Good student discount: Students with good grades can often receive a discount on their car insurance premiums.

- Affiliation discounts: Some insurance companies offer discounts to members of certain organizations or professions.

Benefits of Bundling Home and Auto Insurance

- Cost savings: Bundling your home and auto insurance can lead to significant savings on both policies.

- Convenience: Managing your insurance policies with one company makes it easier to keep track of payments and coverage.

- Add-on discounts: Some insurance companies offer additional discounts or benefits to customers who bundle multiple policies.

Tips for Qualifying for Discounts

- Drive safely: Maintaining a clean driving record is one of the best ways to qualify for discounts on your car insurance.

- Install safety features: Vehicles equipped with safety features such as anti-theft devices, airbags, and anti-lock brakes may be eligible for discounts.

- Drive less: Some insurance companies offer discounts to policyholders who drive fewer miles each year.

Final Review

In conclusion, shopping for car insurance quotes the smart way is not just about saving money but also about finding the perfect coverage that suits your needs. With the right tools and knowledge, you can navigate the insurance landscape with confidence and ease.

Questions and Answers

Why is it important to compare car insurance quotes?

Comparing car insurance quotes helps you find the best coverage at the most competitive rates, saving you money in the long run.

How do I customize insurance quotes to fit my needs?

You can customize insurance quotes by adjusting coverage limits, deductibles, and adding specific add-ons or discounts tailored to your requirements.

What factors should I consider when comparing insurance quotes?

Key factors to consider include the type of coverage, deductibles, premiums, and any discounts available to ensure you get the most suitable policy.