Delving into the realm of small business insurance, this guide uncovers crucial aspects of Coverage Gaps to Avoid in Small Business Policies. From factors causing these gaps to essential insurance types, this topic is essential for any business owner.

Exploring the intricacies of insurance coverage for small businesses reveals the nuances that can make a significant difference in protecting your enterprise.

Factors Contributing to Coverage Gaps

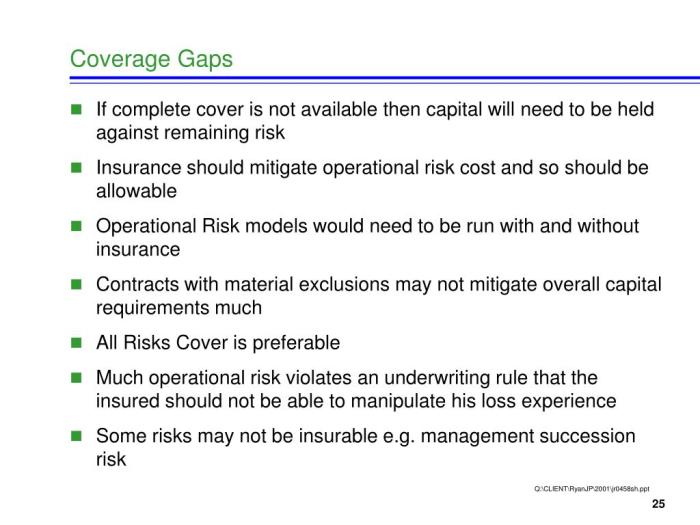

Small business insurance policies are designed to protect businesses from unforeseen events, but certain factors can lead to coverage gaps that leave them vulnerable. Understanding these factors is crucial for small business owners to ensure they have adequate protection.

Lack of Understanding of Policy Coverage

One common factor contributing to coverage gaps is the lack of understanding of what is covered under the insurance policy. Small business owners may assume they are fully protected, only to realize too late that certain events or damages are not included in their coverage.

Underestimating Risks

Another factor is underestimating the risks associated with their business operations. Small business owners may not anticipate certain liabilities or damages, leading to gaps in coverage when these events occur.

Choosing Inadequate Coverage Limits

Opting for lower coverage limits to save on premiums can also result in coverage gaps. In the event of a significant loss, small businesses with inadequate coverage may struggle to cover the costs, putting their financial stability at risk.

Changes in Business Operations

Failure to update insurance policies to reflect changes in business operations can create coverage gaps. For example, expanding into new markets or offering new services without adjusting the policy accordingly can leave businesses exposed to risks that are not covered.

Exclusions and Limitations

Insurance policies often come with exclusions and limitations that may not be immediately apparent. Small business owners need to carefully review their policies to understand what is not covered to avoid gaps in protection.

Types of Insurance Coverage Essential for Small Businesses

Insurance coverage is vital for small businesses to protect themselves from potential risks and liabilities. Here are key types of insurance coverage that small businesses should consider:

1. General Liability Insurance

- General liability insurance provides coverage for third-party bodily injuries, property damage, and advertising injuries.

- It is essential for small businesses to protect themselves from lawsuits and claims that may arise from accidents or negligence.

- General liability insurance can help cover legal fees, settlements, and medical expenses.

2. Property Insurance

- Property insurance covers physical assets such as buildings, equipment, inventory, and furniture.

- It protects small businesses from losses due to fire, theft, vandalism, or natural disasters.

- Having property insurance ensures that the business can recover and continue operations after a covered loss.

3. Workers' Compensation Insurance

- Workers' compensation insurance is mandatory for businesses with employees and provides coverage for work-related injuries and illnesses.

- It helps cover medical expenses, lost wages, and disability benefits for employees who are injured on the job.

- Having workers' compensation insurance not only protects employees but also shields the business from potential lawsuits related to workplace injuries.

4. Professional Liability Insurance

- Professional liability insurance, also known as errors and omissions insurance, protects businesses that provide professional services from claims of negligence or inadequate work.

- It is essential for small businesses, such as consultants, lawyers, and accountants, to protect themselves from malpractice lawsuits.

- Professional liability insurance can cover legal expenses, settlements, and damages awarded in a lawsuit.

Risk Assessment and Customization

Conducting a thorough risk assessment is crucial for small businesses to identify potential threats and vulnerabilities that could impact their operations

Customization of insurance policies plays a key role in avoiding coverage gaps by tailoring coverage to specific risks faced by the business.

Importance of Risk Assessment

A comprehensive risk assessment allows small businesses to evaluate their unique risks and exposures, helping them prioritize areas that require adequate insurance coverage.

- Identifying potential risks such as property damage, liability claims, or business interruptions.

- Evaluating the likelihood and potential impact of each risk on the business.

- Assessing current risk management strategies and their effectiveness.

Customizing Insurance Policies

Customizing insurance policies can help small businesses bridge coverage gaps by ensuring that their specific risks are adequately addressed.

- Working with an insurance agent or broker to tailor coverage limits and endorsements to match the business's needs.

- Considering industry-specific risks and regulations when customizing insurance policies.

- Reviewing and updating insurance coverage regularly to adapt to changing business risks.

Strategies for Tailoring Coverage

Implementing strategies to tailor insurance coverage can enhance protection for small businesses and mitigate potential gaps in coverage.

- Bundle multiple insurance policies into a comprehensive business owner's policy (BOP) for cost-effective coverage.

- Consider adding umbrella insurance for additional liability coverage beyond standard policy limits.

- Explore specialized insurance options such as cyber liability insurance for protection against data breaches and cyber attacks.

Reviewing Policy Terms and Exclusions

When it comes to small business insurance, reviewing policy terms and exclusions is crucial to avoid coverage gaps that could leave your business vulnerable. Understanding the specific details of your policy can help you make informed decisions and ensure you have the protection you need.

Common Exclusions in Small Business Policies

- Intentional acts: Most insurance policies do not cover damages or losses resulting from intentional acts by the insured party.

- Natural disasters: Some policies may have exclusions for certain natural disasters like earthquakes or floods, requiring additional coverage.

- Cyber attacks: Cyber liability coverage is often an add-on to traditional policies, as many standard policies do not cover losses from cyber attacks.

Best Practices for Understanding and Negotiating Policy Terms

- Read the fine print: Take the time to carefully review all policy terms, conditions, and exclusions to fully understand what is covered and what is not.

- Ask questions: If there are terms or exclusions that are unclear, don't hesitate to ask your insurance provider for clarification.

- Consider customization: Work with your insurance agent to customize your policy to address specific risks and ensure comprehensive coverage for your business.

Epilogue

In conclusion, safeguarding your small business from coverage gaps is paramount for financial security. By understanding the risks, essential coverage types, and policy terms, you can navigate the complex insurance landscape with confidence.

FAQ Explained

What are some common factors contributing to coverage gaps?

Factors such as underestimating risks, inadequate coverage limits, and not reviewing policy terms can lead to coverage gaps.

Why is a thorough risk assessment important for small businesses?

A risk assessment helps identify potential threats and vulnerabilities, allowing businesses to tailor their insurance coverage effectively.

How can customization of insurance policies help avoid coverage gaps?

Customizing policies ensures that specific risks faced by a business are adequately covered, reducing the chances of any gaps in coverage.

What are some common policy exclusions that may result in coverage gaps?

Policy exclusions like acts of terrorism, cyber attacks, or natural disasters can leave businesses vulnerable to coverage gaps.

How can businesses negotiate policy terms for comprehensive coverage?

Businesses should carefully review policy terms, seek clarification on any ambiguous clauses, and negotiate changes to ensure comprehensive coverage.