Exploring the realm of Best Low-Cost Insurance Options for Small Businesses Worldwide, this introduction sets the stage for an informative journey, blending a mix of engaging insights and practical advice in a formal yet approachable manner.

The subsequent paragraph will delve deeper into the intricacies of the topic, offering detailed explanations and clarifications.

Overview of Low-Cost Insurance Options for Small Businesses

Low-cost insurance for small businesses refers to affordable insurance plans specifically designed to meet the needs of small enterprises without breaking the bank. These insurance options offer coverage for various risks that businesses may face, such as liability, property damage, or employee injuries.

Having insurance coverage is crucial for small businesses as it provides financial protection in case of unexpected events or accidents. It helps businesses mitigate risks and liabilities, ensuring continuity of operations and safeguarding against potential financial losses that could be detrimental to the business's survival.

Benefits of Low-Cost Insurance Options

- Cost-Effective: Low-cost insurance options are tailored to the budget constraints of small businesses, offering essential coverage at affordable premiums.

- Customizable Plans: These insurance options allow businesses to choose coverage based on their specific needs, avoiding unnecessary expenses on coverage they don't require.

- Quick and Easy Application Process: Low-cost insurance plans typically have simplified application processes, making it convenient for small business owners to get the coverage they need without extensive paperwork or delays.

- Flexible Payment Options: Many low-cost insurance options offer flexible payment plans, allowing businesses to manage their cash flow effectively while ensuring continuous coverage.

Types of Low-Cost Insurance Available Worldwide

When it comes to finding low-cost insurance options for small businesses worldwide, there are several types of coverage that are typically affordable and provide essential protection against various risks.

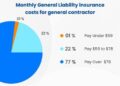

General Liability Insurance

General liability insurance is a foundational policy that covers legal costs and damages if your business is sued for bodily injury, property damage, or advertising injury. This type of insurance is crucial for small businesses as it can protect against common liabilities that may arise during operations.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims of negligence or inadequate work. This type of insurance is particularly important for service-based businesses or professionals who provide advice or expertise to clients.

Property Insurance

Property insurance covers your business property, including buildings, equipment, inventory, and furniture, against damage or loss due to events like fire, theft, or natural disasters. Small businesses can benefit from property insurance to safeguard their assets and ensure continuity of operations.

Business Owner's Policy (BOP)

A Business Owner's Policy combines general liability insurance and property insurance into a single package, offering cost savings for small businesses. This comprehensive coverage is designed to protect against common risks faced by small businesses in one convenient policy.

Workers' Compensation Insurance

Workers' compensation insurance is mandatory in many countries and provides benefits to employees who suffer work-related injuries or illnesses. This type of insurance helps small businesses cover medical expenses and lost wages for employees, reducing the financial burden in case of accidents.

Commercial Auto Insurance

Commercial auto insurance covers vehicles used for business purposes, protecting against accidents, theft, and damage. Small businesses that rely on company vehicles or transport goods can benefit from commercial auto insurance to mitigate risks associated with driving.

Cyber Liability Insurance

Cyber liability insurance helps small businesses protect against data breaches, cyberattacks, and other cyber threats. With the increasing reliance on digital technology, this type of insurance can provide coverage for costs related to data recovery, legal expenses, and customer notification in case of a cyber incident.

Business Interruption Insurance

Business interruption insurance compensates small businesses for lost income and ongoing expenses if they are unable to operate due to covered events, such as natural disasters or property damage. This coverage can help businesses stay afloat during challenging times and maintain financial stability.

Health Insurance for Employees

Providing health insurance benefits for employees is essential for small businesses to attract and retain talent. By offering affordable health insurance options, small businesses can prioritize the well-being of their employees while remaining competitive in the market.

Factors to Consider When Choosing Low-Cost Insurance

When selecting a low-cost insurance plan for a small business, several factors need to be taken into consideration to ensure adequate coverage without breaking the bank.

Impact of Business Nature on Insurance Choice

Different types of businesses have varying insurance needs based on the nature of their operations. For example, a retail store may require liability insurance to protect against customer injuries, while a construction company may need coverage for equipment and property damage.

Importance of Coverage Limits, Deductibles, and Premiums

- Coverage Limits: It is crucial to assess the coverage limits offered by an insurance plan to ensure that it meets the specific needs of the business. Insufficient coverage may leave the business vulnerable in case of a claim.

- Deductibles: Choosing the right deductible amount is essential to strike a balance between out-of-pocket expenses and monthly premiums. A higher deductible typically results in lower premiums but may require the business to pay more in case of a claim.

- Premiums: Small businesses often have budget constraints, so it is important to compare premium costs from different insurers to find a balance between affordability and coverage quality.

Best Practices for Saving Costs on Small Business Insurance

When it comes to small business insurance, finding ways to save costs can significantly impact your bottom line. Here are some best practices to help you save money on insurance premiums and negotiate lower rates with providers.

Tips for Saving Money on Insurance Premiums

- Shop around and compare quotes from different insurance providers to ensure you are getting the best deal.

- Consider increasing your deductibles to lower your premiums, but make sure you can afford the out-of-pocket costs if you need to make a claim.

- Implement risk management strategies to reduce the likelihood of claims, which can help lower your premiums over time.

Strategies for Negotiating Lower Rates

- Highlight your business's positive aspects, such as a good credit history or safety measures in place, to potentially qualify for discounts.

- Ask your insurance provider about available discounts or promotions that you may qualify for based on your business operations.

- Consider bundling multiple insurance policies with the same provider to receive a discounted rate on your premiums.

Advice on Bundling Insurance Policies

- Bundle your general liability, property, and business interruption insurance policies together to potentially save money on premiums.

- Discuss with your insurance provider the possibility of customizing a bundle that meets your specific business needs while maximizing cost savings.

- Review your insurance coverage regularly to ensure you are not overinsured or underinsured, and adjust your policies accordingly to save costs.

Closing Summary

Concluding our discussion on Best Low-Cost Insurance Options for Small Businesses Worldwide, this final section encapsulates the key points discussed, leaving readers with a lasting impression on the importance of securing affordable insurance coverage.

FAQ Explained

What factors should small businesses consider when choosing low-cost insurance?

Small businesses should take into account their specific needs, coverage limits, deductibles, and overall premiums to ensure they select a plan that meets their requirements without compromising quality.

How can small businesses save costs on insurance premiums?

Small businesses can explore options like bundling policies, negotiating rates with providers, and implementing risk management strategies to effectively reduce insurance expenses.

Why is insurance coverage important for small businesses?

Insurance coverage provides financial protection against unforeseen events, liabilities, and risks that could potentially threaten the stability and continuity of a small business.