As we delve into the realm of insurance plans tailored for flooring installers in 2025, a world of possibilities and essential coverage options unfolds. This engaging discussion will explore the nuances of insurance types, emerging trends, customized plans, and cost-effective strategies, providing valuable insights for those in the flooring industry.

Types of Insurance Coverage

Insurance coverage is essential for flooring installers to protect themselves, their business, and their clients from potential risks and liabilities. Here are the different types of insurance coverage available for flooring installers in 2025:

General Liability Insurance

General liability insurance provides coverage for bodily injury, property damage, and advertising injury claims made against your flooring installation business. This type of insurance is essential for flooring installers as it protects them in case of accidents or damages that occur during the course of their work.

General liability insurance can help cover legal fees, medical expenses, and repair costs, providing peace of mind to flooring installers and their clients.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is another crucial coverage for flooring installers. This type of insurance protects flooring installers from claims of negligence, errors, or omissions in their work. Professional liability insurance can cover legal fees, settlements, and judgments that arise from lawsuits related to the quality of the flooring installation or advice provided.

It is especially important for flooring installers who want to safeguard their reputation and finances in case of disputes with clients.

Comparison of Benefits

- General liability insurance provides coverage for bodily injury, property damage, and advertising injury claims, while professional liability insurance protects against claims of negligence or errors in work.

- General liability insurance is more focused on physical damages and accidents, while professional liability insurance is tailored to protect against professional mistakes or oversights.

- Both types of insurance are essential for flooring installers to have comprehensive coverage and peace of mind while running their business in 2025.

Emerging Trends in Insurance

Insurance trends for flooring installers in 2025 are evolving rapidly to keep up with the changing landscape of the industry. Technological advancements and the impact of climate change are two key factors shaping the insurance options available to flooring installers today.

Technology Impact

Technology is revolutionizing the insurance industry, offering flooring installers new tools to assess risks and streamline the claims process. For example, the use of drones for property inspections can provide more accurate data for underwriting policies. Additionally, mobile apps are making it easier for flooring installers to access their insurance information on the go, improving efficiency and communication with insurers.

Climate Change Considerations

Climate change is increasingly influencing insurance options for flooring installers, as extreme weather events become more common. Insurers are adjusting their policies to account for the increased risk of damage due to floods, hurricanes, and other natural disasters. This may lead to changes in coverage limits, pricing, and risk assessment criteria for flooring installers, prompting them to reevaluate their insurance needs to ensure adequate protection against climate-related risks.

Customized Insurance Plans

When it comes to designing a customized insurance plan for flooring installers, it is essential to consider the specific risks and exposures that these professionals face in their line of work. A comprehensive insurance plan tailored for flooring installers should include key components that provide adequate coverage and protection.

Additionally, add-on coverages can be considered to enhance the level of protection further

Key Components of a Comprehensive Insurance Plan for Flooring Installers

- General Liability Insurance: This coverage protects flooring installers against third-party claims of bodily injury or property damage that may occur during the course of their work.

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects flooring installers against claims of negligence, errors, or omissions in their work that result in financial losses for their clients.

- Commercial Property Insurance: This coverage protects flooring installers' business property, including tools, equipment, and inventory, against risks such as theft, fire, or natural disasters.

- Workers' Compensation Insurance: This coverage is essential for flooring installers who have employees, as it provides benefits to employees who are injured or become ill on the job.

Examples of Add-On Coverages for Enhanced Protection

- Business Interruption Insurance: This coverage provides financial protection to flooring installers in case their business operations are disrupted due to a covered loss, such as a fire or natural disaster.

- Commercial Auto Insurance: If flooring installers use vehicles for work purposes, commercial auto insurance can provide coverage for accidents, damage to the vehicle, and liability claims.

- Tool and Equipment Coverage: This coverage protects flooring installers' tools and equipment, such as saws, drills, and other specialized tools, against theft, damage, or loss.

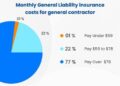

Cost-effective Insurance Strategies

When it comes to obtaining the best insurance coverage for flooring installers, cost-effectiveness is key. By implementing smart strategies, flooring installers can ensure they have adequate coverage without breaking the bank.

Importance of Risk Assessment

Before selecting an insurance plan, it is crucial for flooring installers to conduct a thorough risk assessment. By identifying potential risks specific to their line of work, they can tailor their insurance coverage accordingly. This not only ensures they are adequately protected but also helps in avoiding unnecessary costs.

Ways to Reduce Insurance Premiums

- Invest in Safety Measures: Implementing safety protocols and providing training to employees can significantly reduce the risk of accidents, leading to lower insurance premiums.

- Choose Higher Deductibles: Opting for a higher deductible can lower monthly premiums, although it is essential to ensure that the deductible amount is manageable in the event of a claim.

- Bundle Policies: Bundling multiple insurance policies, such as general liability and workers' compensation, with the same provider can often result in discounted rates.

- Maintain a Good Claims History: A history of few or no claims can demonstrate to insurers that you are a lower risk, potentially leading to lower premiums.

- Review Coverage Regularly: As business needs evolve, it is important to review insurance coverage regularly to ensure that it is still relevant and cost-effective.

Last Point

In conclusion, navigating the landscape of insurance plans for flooring installers in 2025 requires a blend of foresight, tailored solutions, and cost-effective approaches. By staying informed and proactive, flooring installers can secure the best insurance coverage to safeguard their business ventures in the years to come.

Helpful Answers

What are the essential types of insurance coverage for flooring installers?

Essential insurance coverage for flooring installers includes general liability insurance, professional liability insurance, and possibly property insurance to protect against damages or loss.

How can technology impact insurance plans for flooring installers in 2025?

Technology can streamline insurance processes, offer digital policy management, and enable data-driven risk assessment for flooring installers, enhancing efficiency and accuracy.

What are some cost-effective strategies for flooring installers to obtain the best insurance coverage?

Cost-effective strategies include bundling policies, opting for higher deductibles, exploring discounts for safety measures, and regularly reviewing and updating insurance needs to align with business growth.