Best Health Insurance for Remote Business Teams sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As remote work becomes more prevalent, ensuring the health and well-being of remote employees is paramount.

Providing the best health insurance for these teams not only safeguards their physical health but also enhances employee satisfaction and retention. Let's delve into the intricacies of selecting the ideal health insurance plan for remote business teams.

Importance of Health Insurance for Remote Business Teams

Health insurance is crucial for remote business teams as it provides financial protection and access to healthcare services for employees working from different locations.

Benefits of Providing Health Insurance to Remote Teams

- Ensures employees have access to quality healthcare services, promoting their well-being and productivity.

- Helps attract top talent and retain skilled professionals in a competitive job market.

- Reduces financial burden on employees by covering medical expenses and preventive care.

- Boosts employee morale and job satisfaction, leading to higher retention rates and lower turnover.

How Health Insurance Contributes to Employee Satisfaction and Retention

- Health insurance coverage shows that employers value their employees' health and well-being, fostering a positive work environment.

- Employees feel more secure and motivated knowing they have access to medical care when needed, reducing stress and absenteeism.

- Health insurance benefits can serve as a competitive advantage for companies, helping them stand out as employers of choice.

Factors to Consider When Choosing Health Insurance for Remote Teams

Choosing the right health insurance for remote teams is crucial for ensuring the well-being of employees scattered across different locations. Several key factors need to be taken into account to make an informed decision.

Coverage Options, Network Size, and Premium Costs

When selecting health insurance for remote teams, it is essential to consider the coverage options provided by the plan. This includes understanding what medical services are covered, such as doctor visits, hospital stays, prescription drugs, and mental health services. Additionally, evaluating the size of the network of healthcare providers available under the plan is vital to ensure employees have access to quality care.

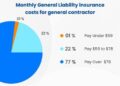

Finally, comparing premium costs is crucial to find a plan that offers adequate coverage at a reasonable price.

Importance of Including Telemedicine Services in the Plan

Telemedicine services have become increasingly important for remote teams, allowing employees to consult with healthcare providers virtually. Including telemedicine services in the health insurance plan enables employees to access medical advice and care without the need for in-person visits, which is especially beneficial for remote workers located far from healthcare facilities.

Comparison of Different Health Insurance Providers for Remote Teams

When choosing health insurance for remote teams, it is essential to compare different providers and their offerings. Look for insurers that specialize in remote work arrangements and offer tailored plans to meet the unique needs of distributed teams

Customizing Health Insurance Plans for Remote Teams

When it comes to remote work setups, it is crucial to customize health insurance plans to meet the specific needs of remote employees. Tailoring these plans can ensure that remote team members have access to the necessary healthcare benefits and support, even when working from different locations.

Examples of Add-On Benefits

- Providing mental health support services such as counseling or therapy sessions can help remote employees manage stress and maintain their well-being.

- Offering wellness programs that focus on healthy lifestyle choices, fitness activities, and nutrition can promote overall health and prevent illnesses.

- Including telemedicine services in the health insurance plan enables remote workers to consult healthcare professionals virtually, saving time and improving access to medical care.

Flexible Reimbursement Options

Flexible reimbursement options can greatly benefit remote employees by allowing them to choose healthcare services that best suit their needs. For example, providing a health savings account (HSA) or a flexible spending account (FSA) can empower remote team members to manage their healthcare expenses efficiently.

Ensuring Compliance and Legal Considerations

When offering health insurance to remote teams, it is crucial to ensure compliance with legal requirements and standards. This includes understanding the differences between local and international health insurance regulations, as well as the implications of offering health insurance across different states or countries.

Local vs. International Health Insurance Regulations

Local health insurance regulations often vary from one state or country to another, requiring businesses to navigate a complex legal landscape. International health insurance regulations add another layer of complexity, as they may involve compliance with the laws of multiple countries.

Implications of Offering Health Insurance Across Different States or Countries

When offering health insurance to remote teams operating in different states or countries, businesses must consider factors such as tax implications, regulatory requirements, and coverage limitations. For example, health insurance plans that comply with the regulations of one state may not meet the standards of another state, leading to potential legal issues.

Ultimate Conclusion

In conclusion, choosing the best health insurance for remote business teams is a crucial decision that impacts both the employees and the company. By prioritizing comprehensive coverage, telemedicine services, and tailored plans, businesses can create a supportive environment for their remote teams.

Remember, investing in the health and well-being of employees is an investment in the success of the business.

FAQ Insights

What are the benefits of providing health insurance to remote teams?

Providing health insurance to remote teams not only ensures their well-being but also enhances job satisfaction, employee retention, and overall productivity.

How can flexible reimbursement options benefit remote employees?

Flexible reimbursement options allow remote employees to choose healthcare services that best suit their needs, promoting personalized and convenient healthcare access.

What are the legal requirements for offering health insurance to remote teams?

Legal requirements may vary by location, but generally, businesses need to comply with regulations related to healthcare coverage, privacy, and employee rights.