Exploring the realm of Affordable Insurance for Restaurants and Food Vendors unveils a crucial aspect of the food industry. Delve into the world of insurance tailored for eateries and vendors, understanding the pivotal role it plays in safeguarding businesses against unforeseen risks.

This introductory paragraph sets the stage for a comprehensive discussion on the importance of affordable insurance in the culinary landscape and its impact on restaurant and food vendor operations.

Importance of Affordable Insurance for Restaurants and Food Vendors

Insurance plays a crucial role in the food industry, providing protection and peace of mind to restaurants and food vendors alike. Affordable insurance can offer numerous benefits and safeguards against potential risks that may arise in the course of business operations.

Significance of Affordable Insurance

Affordable insurance enables restaurants and food vendors to mitigate financial losses in the event of unforeseen circumstances such as property damage, liability claims, or employee injuries. It serves as a safety net, ensuring that businesses can continue to operate smoothly even in challenging situations.

Benefits of Affordable Insurance

- Financial Protection: Affordable insurance policies can cover costs related to property damage, theft, or legal claims, reducing the financial burden on restaurants and food vendors.

- Peace of Mind: Knowing that they are adequately covered by insurance allows businesses to focus on providing quality service to their customers without worrying about potential risks.

- Compliance Requirements: Many states and landlords require restaurants and food vendors to have insurance coverage in place, making it essential for legal compliance.

Risks of Operating Without Proper Insurance

- Legal Liabilities: Without insurance, restaurants and food vendors may face significant legal liabilities in the event of accidents, injuries, or property damage, leading to costly lawsuits and settlements.

- Financial Losses: Unexpected events such as natural disasters or theft can result in substantial financial losses for businesses without insurance coverage, potentially jeopardizing their operations.

- Reputation Damage: Failure to address customer complaints or compensate for damages can tarnish the reputation of restaurants and food vendors, impacting customer trust and loyalty.

Types of Insurance Coverage for Restaurants and Food Vendors

When it comes to running a restaurant or food vendor business, having the right insurance coverage is crucial to protect your investment and livelihood. There are several types of insurance policies available to help mitigate risks and ensure financial security in case of unforeseen events.

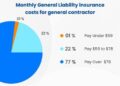

General Liability Insurance

General liability insurance is essential for restaurants and food vendors as it provides coverage for third-party bodily injury, property damage, and advertising injury claims. This type of insurance protects against lawsuits and claims that may arise from accidents or negligence on your business premises.

Property Insurance

Property insurance is designed to protect the physical assets of your restaurant or food vendor business, including the building, equipment, inventory, and fixtures. In the event of fire, theft, vandalism, or other covered perils, property insurance can help cover the cost of repairs or replacement of damaged property.

Workers' Compensation Insurance

Workers' compensation insurance is mandatory for businesses with employees and provides coverage for medical expenses, lost wages, and disability benefits in case an employee is injured or becomes ill on the job. This type of insurance not only protects your employees but also protects your business from potential lawsuits related to workplace injuries.Each type of insurance plays a critical role in safeguarding your restaurant or food vendor business from various risks and liabilities.

By having the right insurance coverage in place, you can focus on growing your business with peace of mind knowing that you are protected financially in case of unexpected events.

Factors Influencing Affordable Insurance Premiums

When it comes to affordable insurance for restaurants and food vendors, there are several key factors that can significantly impact insurance premiums. Understanding these factors is crucial for business owners to make informed decisions and manage costs effectively.

Business Size

The size of a restaurant or food vendor business plays a major role in determining insurance premiums. Larger businesses with more employees, revenue, and assets are generally exposed to higher risks, which can lead to higher premiums. Smaller businesses, on the other hand, may have lower premiums due to their reduced risk profile.

Location

The location of a restaurant or food vendor can also influence insurance premiums. Businesses located in high-crime areas or regions prone to natural disasters may face higher premiums due to increased risk. Conversely, establishments in low-risk areas may benefit from lower insurance costs.

Services Offered

The type of services offered by a restaurant or food vendor can impact insurance premiums as well. Businesses that provide delivery services, serve alcohol, or offer catering may face higher premiums due to the added risks associated with these activities.

It is important for business owners to accurately disclose all services offered to ensure proper coverage and pricing.

Strategies to Mitigate Premium Increases

- Implementing risk management practices such as employee training, proper maintenance, and safety protocols can help reduce the likelihood of claims, which in turn can help lower insurance premiums.

- Shopping around and comparing quotes from different insurance providers can help businesses find the most competitive rates and coverage options.

- Reviewing and updating insurance policies regularly to ensure they accurately reflect the business's current operations and risks can help prevent overpaying for coverage that is no longer needed.

- Working with an experienced insurance agent or broker who specializes in restaurant and food vendor insurance can provide valuable insights and guidance on cost-saving strategies.

Tips for Finding Affordable Insurance Providers

When looking for affordable insurance providers for your restaurant or food vendor business, it's important to follow these tips to ensure you get the best coverage at a reasonable rate.

Research and Compare Insurance Providers

Before making a decision, take the time to research and compare different insurance providers. Look at their offerings, rates, and customer reviews to get a sense of their reputation and reliability. By comparing multiple options, you can find the best coverage for your specific needs at a competitive price.

Read Policy Details and Understand Coverage Limits

It's crucial to carefully read through the policy details and understand the coverage limits of each insurance provider you are considering. Make sure you are aware of what is covered and what is not, so there are no surprises down the line.

Understanding the fine print will help you choose a policy that meets your requirements without any hidden costs.

Negotiate Affordable Insurance Rates

Don't be afraid to negotiate with insurance providers to get the most affordable rates for your restaurant or food vendor business. Ask for discounts, bundle policies if possible, or consider increasing deductibles to lower premiums. Building a good relationship with your insurance agent can also lead to better deals and savings in the long run.

Last Word

In conclusion, Affordable Insurance for Restaurants and Food Vendors is not just a protective measure but a strategic investment in the longevity of businesses in the food sector. By understanding the nuances of insurance coverage and exploring cost-effective options, establishments can thrive in a competitive market while mitigating potential risks.

FAQ Insights

What are the key risks of operating without proper insurance in the food industry?

Operating without insurance leaves restaurants and food vendors vulnerable to potential lawsuits, property damage, and financial losses in case of accidents or unforeseen circumstances. Having insurance provides a safety net against these risks.

How can restaurants and food vendors lower their insurance premiums?

To reduce insurance costs, businesses can implement safety measures, maintain a good claims history, choose appropriate coverage limits, and compare quotes from different providers to find the most competitive rates.