Exploring the realm of Life and Critical Illness Cover reveals essential information that can impact individuals and families. Dive into this comprehensive guide to gain a deeper understanding of the nuances surrounding this crucial topic.

Delve into the intricacies of insurance coverage and discover the pivotal role it plays in safeguarding financial stability during life's unpredictable moments.

Understanding Life and Critical Illness Cover

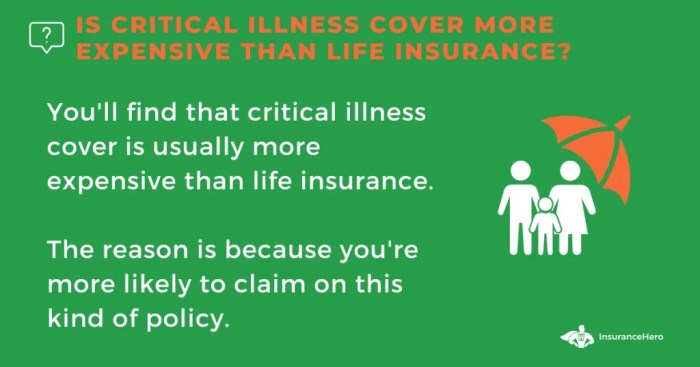

Life and critical illness cover are types of insurance policies that provide financial protection in case of unexpected events. Life insurance is designed to provide a lump sum payment to your beneficiaries in the event of your death. This can help cover expenses such as mortgage payments, debts, or provide financial security for your loved ones.On the other hand, critical illness cover offers a payout if you are diagnosed with a serious illness that is covered by the policy.

This can help cover medical expenses, loss of income, or any other financial burdens that may arise due to the illness.It is important to have both types of coverage because they serve different purposes. Life insurance provides financial support to your loved ones after your passing, while critical illness cover offers protection if you are diagnosed with a serious illness during your lifetime.

Having both types of coverage ensures comprehensive financial protection for you and your family in various situations.

Benefits of Life and Critical Illness Cover

Life insurance and critical illness cover provide essential financial protection for individuals and families in times of need. Let's explore the key benefits of these two types of insurance.

Key Benefits of Life Insurance

- Financial Security: Life insurance provides a lump sum payment to your beneficiaries in the event of your death. This ensures that your loved ones are financially protected and can maintain their standard of living.

- Debt Repayment: Life insurance can be used to pay off any outstanding debts such as mortgages, loans, or credit card balances, relieving your family from financial burden.

- Estate Planning: Life insurance can help with estate planning by providing liquidity to cover any estate taxes or expenses, ensuring a smooth transfer of assets to your heirs.

- Income Replacement: The death benefit from life insurance can replace your lost income, allowing your family to meet their financial needs and obligations.

Advantages of Critical Illness Cover

- Financial Protection: Critical illness cover pays out a lump sum if you are diagnosed with a serious illness covered by the policy. This money can be used to cover medical expenses, rehabilitation costs, or any necessary lifestyle adjustments.

- Peace of Mind: Knowing that you have critical illness cover in place can provide peace of mind for you and your family, knowing that you are financially protected in case of a health crisis.

- Additional Support: Some critical illness policies offer additional benefits such as access to specialist treatments, second medical opinions, or support services to help you navigate your diagnosis and recovery.

- Flexible Usage: The lump sum payout from critical illness cover can be used in any way you see fit, whether it's to cover medical bills, make necessary home modifications, or even take a break from work to focus on your health.

Both life insurance and critical illness cover play a crucial role in providing financial security and peace of mind to individuals and families, ensuring that they are protected against unexpected events and can focus on what matters most during challenging times.

Types of Life and Critical Illness Cover

When it comes to life and critical illness cover, there are various types of insurance policies available to suit different needs and preferences. Let's explore the different types of life insurance policies and critical illness cover options, as well as compare and contrast term life insurance with whole life insurance.

Types of Life Insurance Policies

- Term Life Insurance: Provides coverage for a specific period, usually 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term.

- Whole Life Insurance: Offers coverage for the entire lifetime of the policyholder. It includes a cash value component that grows over time and can be used for loans or withdrawals.

- Universal Life Insurance: Flexible policy that allows adjustments to premiums and coverage amounts. It also accumulates cash value and offers a death benefit.

- Variable Life Insurance: Combines death benefit protection with investment options. The cash value of the policy is invested in sub-accounts similar to mutual funds.

Types of Critical Illness Cover

- Stand-Alone Critical Illness Cover: Provides a lump sum payment if the policyholder is diagnosed with a covered critical illness. It is separate from life insurance and can be used for medical expenses or other financial needs.

- Accelerated Critical Illness Cover: Offers an advance payment of the life insurance death benefit if the policyholder is diagnosed with a critical illness. The death benefit is reduced by the amount paid out for the critical illness claim.

- Combined Life and Critical Illness Cover: Combines life insurance with critical illness cover in a single policy. It provides financial protection in case of death or critical illness diagnosis.

Term Life Insurance vs. Whole Life Insurance

- Term Life Insurance: Provides coverage for a specific period and is generally more affordable than whole life insurance. It does not have a cash value component and is suitable for temporary needs.

- Whole Life Insurance: Offers lifetime coverage with a cash value component that grows over time. It is more expensive than term life insurance but provides long-term financial security and investment opportunities.

Factors to Consider When Choosing Coverage

When it comes to selecting life insurance and critical illness cover, there are several important factors to consider to ensure you get the right protection for your needs. Let's explore the key considerations for choosing these types of coverage and provide tips on determining the appropriate coverage amount.

Factors for Choosing Life Insurance

- Consider your financial responsibilities: Think about your outstanding debts, mortgage, and the financial needs of your dependents.

- Evaluate your long-term goals: Determine if you want the policy to provide for your family's future or cover specific expenses like education or retirement.

- Assess your health and age: Your health condition and age can affect the cost and availability of life insurance policies.

- Review the policy features: Look into the different types of life insurance policies available, such as term, whole life, or universal life, and choose one that aligns with your goals.

- Consider the coverage amount: Calculate the total amount of coverage needed to ensure your loved ones are financially secure in your absence.

Factors for Choosing Critical Illness Cover

- Understand the illnesses covered: Review the list of critical illnesses included in the policy and ensure it aligns with your health risks.

- Check the payout structure: Determine if the policy provides a lump sum payout or staggered payments upon diagnosis of a covered illness.

- Evaluate the waiting period: Consider the waiting period before you can make a claim after being diagnosed with a critical illness.

- Assess the coverage amount: Calculate the amount needed to cover medical expenses, loss of income, and other financial obligations during illness recovery.

Tips for Determining the Appropriate Coverage Amount

- Calculate your financial needs: Determine the total amount required to cover debts, living expenses, education costs, and other financial obligations.

- Consider inflation and future expenses: Account for inflation and future financial needs when deciding on the coverage amount.

- Consult with a financial advisor: Seek advice from a professional to help you calculate the appropriate coverage amount based on your individual circumstances.

- Review and update your coverage: Regularly review your life insurance and critical illness cover to ensure it aligns with your current financial situation and needs.

Claim Process for Life and Critical Illness Cover

When it comes to life and critical illness cover, understanding the claim process is essential to ensure a smooth experience during difficult times. Let's dive into the steps involved in filing a claim for life insurance and critical illness cover, as well as common reasons why claims may get rejected and how to avoid them.

Life Insurance Claim Process

- Notify the Insurance Company: Contact your insurance provider as soon as possible to inform them about the policyholder's death.

- Submit Documentation: You will need to provide the necessary documents, such as the death certificate, policy documents, and any other required paperwork.

- Claim Assessment: The insurance company will assess the claim based on the policy terms and conditions to determine if it is valid.

- Payment: If the claim is approved, the insurance company will process the payment to the beneficiaries mentioned in the policy.

Critical Illness Cover Claim Process

- Diagnosis Confirmation: Once diagnosed with a critical illness covered by the policy, inform the insurance company and provide medical evidence.

- Claim Form Submission: Complete the claim form accurately and submit it along with the required medical reports and documents.

- Claim Evaluation: The insurance company will review the provided information to assess the claim and determine its validity.

- Benefits Payment: If the claim is approved, the policyholder will receive the lump sum benefit amount to cover medical expenses or other financial needs.

Common Reasons for Rejected Claims and How to Avoid Them

- Non-Disclosure: Failing to disclose relevant information or medical history can lead to claim rejection. Be honest and provide accurate details when applying for coverage.

- Policy Exclusions: Understand the policy exclusions and limitations to avoid claiming for situations not covered by the policy.

- Missed Premium Payments: Ensure timely payment of premiums to keep the policy active and eligible for claims when needed.

- Claim Documentation: Submit all required documents promptly and accurately to avoid delays or rejection of the claim.

Importance of Reviewing and Updating Coverage

Regularly reviewing and updating life insurance and critical illness cover is essential to ensure that your policies continue to meet your needs and provide adequate protection for you and your loved ones.

Why Review Life Insurance Policies Regularly

Life insurance needs can change over time due to various factors such as marriage, the birth of children, changes in income, or significant life events. It's crucial to review your life insurance coverage regularly to make sure it aligns with your current financial situation and future goals.

Significance of Updating Critical Illness Cover

Critical illness cover should be updated as circumstances change to ensure that you are adequately protected against the financial impact of a serious illness. As medical advancements continue to evolve, updating your critical illness cover can provide access to new treatments and technologies that may not have been available when you initially purchased the policy.

Guidelines on When and Why Coverage Should be Reassessed

- Reassess your coverage after major life events such as marriage, divorce, the birth of a child, or purchasing a new home.

- Consider updating your coverage if your income has significantly increased or decreased.

- Review your policies annually to ensure that they still meet your needs and provide adequate protection.

- Consult with a financial advisor or insurance professional to reassess your coverage and make any necessary adjustments.

Closing Summary

In conclusion, The Truth About Life and Critical Illness Cover sheds light on the vital aspects of insurance protection, emphasizing the need for careful consideration and informed decisions in securing a stable future.

Q&A

What is the difference between life insurance and critical illness cover?

Life insurance provides a lump sum payment to beneficiaries upon the policyholder's death, while critical illness cover pays out upon diagnosis of a serious medical condition.

How can one determine the appropriate coverage amount?

Factors such as income, debt, and future financial needs should be considered to determine the right coverage amount for both life and critical illness insurance.

What are common reasons why claims for critical illness cover may get rejected?

Claims may get rejected due to non-disclosure of medical history, pre-existing conditions not covered in the policy, or failure to meet specific criteria Artikeld in the policy.

When should one reassess their coverage?

Coverage should be reassessed when major life events occur, such as marriage, having children, changing jobs, or significant changes in health status.