Embarking on the journey of selecting the best business health insurance in 2025 unveils a landscape filled with crucial decisions and innovative solutions. From demographic trends to cutting-edge technology integration, the process is both complex and fascinating.

As we delve deeper into the realm of business health insurance, we uncover a multitude of factors that shape the choices available to companies in the ever-evolving healthcare market.

Factors to Consider When Choosing Business Health Insurance in 2025

When selecting health insurance for your business in 2025, it is crucial to consider various factors that can impact your decision-making process. From demographic trends to regulatory changes, understanding the landscape of health insurance options is essential for making informed choices.

Key Demographic Trends Impacting Health Insurance Selection

In 2025, businesses need to pay attention to key demographic shifts that can influence the type of health insurance plans they choose. Factors such as the aging workforce, increasing diversity, and changes in lifestyle habits can all play a role in determining the most suitable coverage for employees.

- As the population ages, businesses may need to consider health insurance plans that cater to older employees with specific healthcare needs.

- The rise of remote work and gig economy workers may require businesses to offer flexible insurance options that can accommodate varying work arrangements.

Evolving Regulatory Landscape and Its Impact on Insurance Options

The regulatory environment surrounding health insurance is constantly evolving, and businesses must stay informed about these changes to ensure compliance and access to the best insurance options for their employees.

- Changes in healthcare laws and policies can impact the cost and coverage of insurance plans, making it vital for businesses to stay up-to-date on regulatory developments.

- New regulations may introduce innovative insurance models or requirements that businesses need to consider when choosing health insurance plans in 2025.

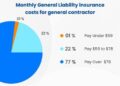

Comparison of Coverage Options for Different Types of Businesses

Different businesses have unique needs when it comes to health insurance, and understanding the coverage options available for various types of businesses can help in making tailored decisions.

- Small businesses may benefit from cost-effective group insurance plans, while larger corporations might opt for self-insured models that offer more control over coverage and costs.

- Start-ups and tech companies may prefer health insurance plans that include wellness initiatives and digital health tools to cater to the needs of their younger workforce.

Innovative Health Insurance Models for Businesses in 2025

In response to changing healthcare trends and employee expectations, innovative health insurance models are emerging to provide businesses with more options and flexibility in designing their insurance plans.

- Value-based insurance designs that prioritize preventive care and wellness programs are gaining popularity among businesses looking to reduce long-term healthcare costs.

- Collaborative care models that involve partnerships between insurers, healthcare providers, and employers are being developed to improve health outcomes and enhance the overall employee experience.

Technology Integration in Business Health Insurance Selection

In today's rapidly evolving digital landscape, technology plays a crucial role in reshaping the insurance industry, particularly in the realm of business health insurance. From artificial intelligence to telemedicine, various technological advancements are transforming how companies choose and manage their health insurance plans.

Artificial Intelligence in Insurance

Artificial intelligence (AI) is revolutionizing the insurance industry by streamlining processes, enhancing customer experience, and improving risk assessment. Through AI-powered algorithms, insurers can analyze vast amounts of data to personalize insurance plans, predict claims, and detect fraudulent activities efficiently.

Telemedicine and Virtual Healthcare Services

Telemedicine and virtual healthcare services have become integral components of modern insurance plans, offering convenient access to medical consultations, remote monitoring, and digital health records. These services not only improve healthcare accessibility but also help reduce costs for both insurers and policyholders.

Wearable Health Technology Impact

The integration of wearable health technology, such as fitness trackers and smartwatches, has led to a shift in insurance premiums and coverage. Insurers can incentivize policyholders to adopt healthier lifestyles by offering discounts based on their health data, ultimately promoting wellness and reducing the risk of chronic conditions.

Blockchain Implementation in Health Insurance

Blockchain technology holds the potential to revolutionize health insurance processes by enhancing data security, streamlining claims processing, and ensuring transparency. By leveraging blockchain, insurers can improve data integrity, prevent fraud, and simplify transactions, ultimately enhancing the overall efficiency of health insurance operations.

Employee Wellness Programs and Health Insurance

Employee wellness programs play a crucial role in promoting the overall health and well-being of employees, which in turn can positively impact the effectiveness of health insurance offerings within a business. Integrating wellness initiatives with health insurance plans can lead to reduced healthcare costs, improved employee productivity, and increased job satisfaction.

Designing Strategies for Integration

Employee wellness initiatives can be seamlessly integrated with health insurance offerings by providing incentives for participation in wellness programs. For example, employers can offer discounts on insurance premiums for employees who actively engage in wellness activities such as gym memberships, nutrition counseling, or stress management programs.

By aligning wellness goals with insurance benefits, employees are motivated to take proactive steps towards better health outcomes.

Successful Wellness Programs

One example of a successful wellness program that has positively impacted insurance costs is the implementation of biometric screenings and health risk assessments. These screenings can help identify potential health risks early on, allowing for targeted interventions and preventive measures to be put in place.

As a result, employees are empowered to make healthier lifestyle choices, leading to reduced healthcare expenses for both the individual and the employer.

Importance of Mental Health Coverage

Mental health coverage is a critical component of any business health insurance plan. With the increasing awareness of mental health issues in the workplace, offering comprehensive mental health benefits can help employees access the care they need. By providing coverage for mental health services such as therapy, counseling, and psychiatric care, employers can support their employees' overall well-being and productivity.

Effectiveness of Preventive Care Incentives

Incentivizing preventive care measures, such as regular health screenings, vaccinations, and wellness check-ups, can significantly reduce long-term healthcare expenses. By encouraging employees to prioritize preventive care, employers can help prevent costly medical conditions from developing or worsening. This proactive approach not only benefits the individual's health but also contributes to lowering overall healthcare costs for the organization.

Customization and Flexibility in Business Health Insurance

In today's competitive business landscape, offering customizable and flexible health insurance plans has become essential for attracting and retaining top talent. Let's explore the advantages and disadvantages of standardized versus customizable insurance plans.

Standardized vs. Customizable Insurance Plans

Standardized insurance plans offer uniform coverage for all employees, simplifying administration and potentially reducing costs. However, they may not meet the diverse needs of a workforce with varying health concerns and preferences. On the other hand, customizable insurance plans allow businesses to tailor coverage options to individual or group needs, providing more comprehensive and personalized benefits.

Importance of Flexible Coverage Options

Offering flexible coverage options is crucial for meeting the diverse needs of employees from different backgrounds, age groups, and health conditions. By providing a range of choices, businesses can empower employees to select the best-suited plan that aligns with their unique requirements, ultimately boosting morale and productivity.

Examples of Tailored Insurance Solutions

For specific industries or employee groups, tailored insurance solutions can address their distinct health concerns. For instance, a construction company may offer coverage for work-related injuries, while a tech startup may focus on mental health benefits and wellness programs to support a young and dynamic workforce.

Role of Data Analytics in Personalizing Health Insurance

Data analytics plays a crucial role in personalizing health insurance packages for businesses. By analyzing employee health data and insurance claims, companies can identify trends, predict future health risks, and tailor insurance plans to address specific needs. This data-driven approach ensures that employees receive targeted and effective healthcare benefits.

Concluding Remarks

In conclusion, navigating the realm of business health insurance in 2025 requires a careful balance of understanding key trends, embracing technological advancements, and prioritizing employee wellness. By making informed decisions, businesses can secure the best possible coverage for their workforce, ensuring a healthy and productive future.

Questions and Answers

What are some key demographic trends to consider when choosing business health insurance in 2025?

Key demographic trends include an aging workforce, increasing diversity in the workplace, and shifting healthcare needs based on generational differences.

How is artificial intelligence revolutionizing the insurance industry in relation to business health insurance?

Artificial intelligence is streamlining administrative tasks, improving data analysis for personalized plans, and enhancing fraud detection, ultimately leading to more efficient and cost-effective insurance solutions.

Why is mental health coverage important within business health insurance plans?

Mental health coverage is crucial as it addresses the holistic well-being of employees, reduces absenteeism, boosts productivity, and creates a supportive work environment.

What are the benefits of offering flexible coverage options for diverse employee needs?

Flexible coverage options cater to varying employee requirements, boost satisfaction, improve retention rates, and ensure that individuals can choose plans that best suit their unique healthcare needs.

How does data analytics play a role in personalizing health insurance packages for businesses?

Data analytics enables insurers to analyze employee health patterns, predict future needs, offer targeted wellness programs, and create customized insurance plans that align with specific business requirements.