When it comes to choosing the right business health plan, the options can be overwhelming. From cost considerations to coverage details, finding the perfect fit for your company is crucial. Let's dive into the world of business health plans and explore which one is the best match for your needs.

As we delve deeper into the intricacies of different health plans, you'll gain valuable insights on how to make an informed decision that benefits both your business and your employees.

Overview of Business Health Plans

Business health plans are essential offerings provided by companies to ensure the well-being of their employees. These plans cover a range of medical expenses and services, promoting the health and productivity of the workforce.

Types of Health Plans Available for Businesses

- Group Health Insurance: This is a common type of health plan where the company purchases a policy to cover all employees.

- Health Maintenance Organization (HMO): Employees choose a primary care physician and must get referrals for specialist visits.

- Preferred Provider Organization (PPO): Offers a network of healthcare providers at a discounted rate, giving employees more flexibility in choosing doctors.

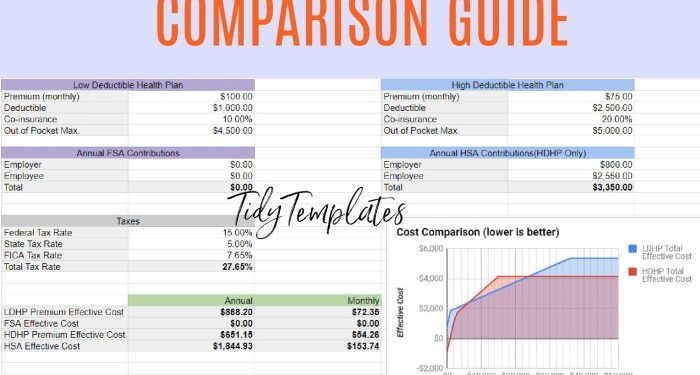

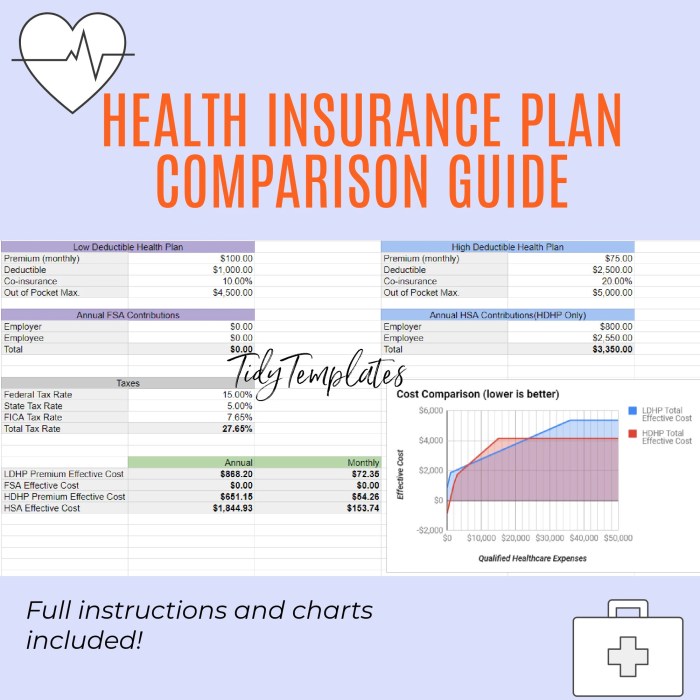

- High Deductible Health Plan (HDHP): Employees pay lower premiums but have higher deductibles, often paired with a Health Savings Account (HSA).

Key Benefits of Offering Health Plans to Employees

- Employee Retention: Providing health benefits can attract and retain top talent within the company.

- Healthier Workforce: Access to healthcare promotes wellness, reducing absenteeism and improving overall productivity.

- Tax Incentives: Companies can benefit from tax deductions by offering health insurance to employees.

- Legal Compliance: Some regulations may require businesses to offer health insurance depending on the size of the company.

Factors to Consider When Comparing Business Health Plans

When comparing business health plans, there are several key factors that businesses should take into consideration to ensure they choose the right plan for their employees.

Cost

The cost of a health plan is a critical factor for businesses to consider. This includes not only the monthly premiums but also any deductibles, copays, and coinsurance that employees may be responsible for. It is essential to strike a balance between offering comprehensive coverage and keeping costs affordable for both the employer and the employees.

Coverage

The coverage provided by a health plan is another crucial factor to consider. Businesses should evaluate what services and treatments are included in the plan, such as doctor visits, prescription drugs, and preventive care. It is important to ensure that the plan meets the healthcare needs of the employees and their families.

Network Size

The size of the provider network is also significant when comparing business health plans. A larger network typically offers more choices for healthcare providers, which can be beneficial for employees who prefer to see specific doctors or specialists. On the other hand, a smaller network may result in lower costs but limited options for care.

Flexibility

Flexibility in a health plan is essential for accommodating the diverse needs of employees. Businesses should consider whether the plan allows for changes in coverage levels, the addition of dependents, or the ability to see out-of-network providers if needed. A flexible plan can help employees feel empowered and supported in managing their healthcare.

Employee Needs and Preferences

Employee needs and preferences should play a significant role in the selection of a health plan. Businesses should gather feedback from employees to understand their healthcare priorities, such as access to specific doctors, coverage for certain medications, or wellness programs.

Tailoring the health plan to meet the needs of employees can lead to higher satisfaction and retention rates.

Reputation and Customer Service

Lastly, evaluating the reputation and customer service of health insurance providers is crucial. Businesses should research the track record of insurance companies in terms of claims processing, provider relations, and member satisfaction. A reliable provider with excellent customer service can make a significant difference in the overall experience of employees using the health plan.

Types of Business Health Plans

Health insurance options for businesses can vary widely, with each type of plan offering different benefits and drawbacks. Understanding the differences between HMOs, PPOs, EPOs, and HDHPs can help businesses choose the right health plan for their employees.

Health Maintenance Organization (HMO)

An HMO plan requires employees to select a primary care physician (PCP) who manages their healthcare needs and provides referrals to specialists when necessary. This type of plan typically has lower out-of-pocket costs but limits the choice of healthcare providers.

Employees must receive care from within the HMO network to be covered.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility in choosing healthcare providers compared to HMOs. Employees can see specialists without a referral and can receive partial coverage for out-of-network care. While PPO plans usually have higher premiums and deductibles than HMOs, they provide more options for employees seeking healthcare services.

Exclusive Provider Organization (EPO)

EPO plans combine elements of HMOs and PPOs, requiring employees to use a specific network of providers for coverage. However, like PPOs, EPO plans do not mandate referrals for specialists. While EPOs offer less flexibility in provider choice compared to PPOs, they often have lower costs and premiums.

High Deductible Health Plan (HDHP)

HDHPs have lower premiums but higher deductibles than other types of health plans. They are often paired with Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs) to help employees cover out-of-pocket costs. HDHPs are suitable for businesses looking to offer cost-effective health coverage, especially for employees who are healthy and do not require frequent medical care.Overall, the choice of health plan for a business may depend on factors such as the size of the company, the healthcare needs of employees, and the budget available for health benefits.

Small businesses may opt for HMOs or EPOs to control costs, while larger companies with more resources may prefer PPOs for greater flexibility and access to a wider network of providers.

Designing a Customized Health Benefits Package

When it comes to designing a health benefits package for a specific business, it is crucial to tailor the plan to meet the unique needs of the company and its employees. This involves a thoughtful consideration of various factors to ensure that the benefits package is both comprehensive and cost-effective.

Structuring a Customized Benefits Package

- Assess the needs: Conduct surveys or interviews with employees to understand their healthcare needs and preferences. This will help in determining which benefits to include in the package.

- Consider the budget: Evaluate the financial resources available for health benefits and allocate funds accordingly. Balance between offering competitive benefits and staying within budget constraints.

- Offer flexibility: Provide options for employees to choose from different benefit plans based on their individual needs. This can include different levels of coverage or the choice to opt-in for additional benefits.

- Communicate effectively: Clearly communicate the details of the benefits package to employees, including eligibility criteria, coverage limits, and how to access healthcare services. This will help in maximizing employee engagement and utilization of benefits.

Role of Voluntary Benefits in Enhancing the Package

- Dental coverage: Including dental benefits can improve overall employee health and well-being, as oral health is closely linked to overall health. It can also help in attracting and retaining top talent.

- Vision coverage: Vision benefits can promote eye health and early detection of vision problems, leading to improved productivity and job satisfaction among employees.

- Mental health coverage: Mental health benefits are essential for supporting employee well-being and reducing stigma around mental health issues. Providing access to counseling services or therapy can help in creating a supportive work environment.

Last Recap

In conclusion, navigating the realm of business health plans requires careful consideration and a thorough understanding of your company's requirements. By weighing the various factors and options available, you can select a plan that not only meets but exceeds your expectations.

Make the right choice for your business and ensure a healthy future for all.

FAQ Resource

What factors should businesses consider when comparing health plans?

Businesses should take into account cost, coverage, network size, flexibility, and employee needs and preferences when evaluating health plans. It's essential to also consider the reputation and customer service of health insurance providers.

What types of business health plans are available?

There are various types including HMOs, PPOs, EPOs, and HDHPs. Each has its own set of pros and cons, suitable for different business sizes or industries.

How can a business design a customized health benefits package?

Businesses can tailor a benefits package based on their specific needs by aligning it with the company's budget and employee preferences. Including voluntary benefits like dental and vision coverage can further enhance the package.