Exploring the realm of finding affordable general liability insurance for contractors, this guide offers valuable insights and practical tips to navigate the complex landscape of insurance options. Dive in to discover how contractors can secure cost-effective coverage without compromising on quality.

Researching General Liability Insurance Options

When it comes to finding the right general liability insurance for contractors, it's essential to research and compare different options to ensure you get the coverage you need at a price that fits your budget. Here are some key points to consider:

Types of General Liability Insurance Policies

- Commercial General Liability (CGL) Insurance: This policy provides coverage for third-party bodily injury, property damage, and advertising injury claims.

- Professional Liability Insurance: Also known as errors and omissions insurance, this policy covers claims of negligence or inadequate work.

- Business Owner's Policy (BOP): This combines general liability insurance with property insurance in a bundled policy.

Tips for Researching and Comparing Insurance Options

- Get Multiple Quotes: Reach out to different insurance providers to compare rates and coverage options.

- Check Ratings and Reviews: Look for feedback from other contractors to assess the reliability of an insurance company.

- Review Coverage Limits and Exclusions: Make sure you understand what is covered and what is not under each policy to avoid any surprises later on.

Importance of Understanding Coverage Limits and Exclusions

- Knowing the coverage limits helps you assess if the policy provides enough protection for your business in case of a claim.

- Understanding exclusions is crucial to avoid gaps in coverage that could leave you vulnerable to financial risks.

- Consult with an insurance agent or broker if you have any questions about the details of a policy.

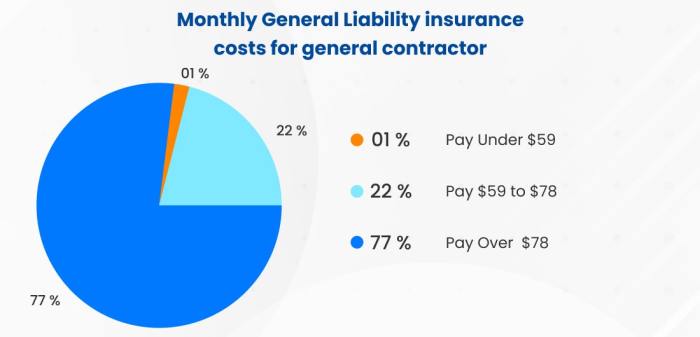

Factors Influencing Insurance Cost

When it comes to general liability insurance for contractors, the cost can vary based on several factors. Understanding these influences can help contractors make informed decisions to manage their insurance expenses effectively.

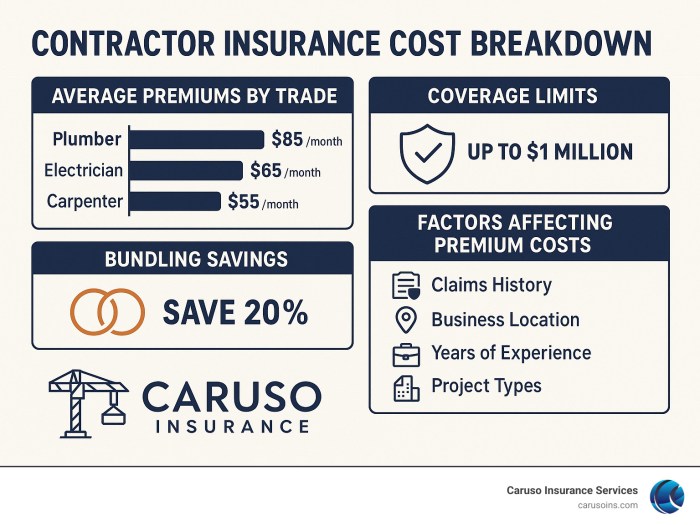

Business Size

The size of a contractor's business can significantly impact the cost of general liability insurance. Larger businesses with more employees and higher revenue typically face higher premiums due to the increased level of risk associated with their operations. Smaller contractors may be able to secure more affordable insurance rates, reflecting their lower risk profile.

Location

The geographical location of a contractor's business is another key factor in determining insurance costs. Areas prone to natural disasters or with higher crime rates may experience higher insurance premiums due to increased risk exposure. Conversely, contractors operating in safer or less risky regions may benefit from lower insurance costs.

Industry

The industry in which a contractor operates can impact insurance premiums as well. Some industries, such as construction or roofing, are considered high-risk and may face higher insurance rates as a result. Contractors in low-risk industries, like consulting or landscaping, may enjoy more affordable insurance options.

Claims History

A contractor's claims history plays a crucial role in determining insurance costs. Contractors with a history of frequent or costly claims are viewed as higher risks by insurance providers, leading to higher premiums. On the other hand, contractors with a clean claims record may qualify for lower insurance rates.

Risk Management Strategies

Implementing effective risk management strategies can help contractors lower their insurance costs. By prioritizing safety measures, providing ongoing training to employees, and maintaining proper documentation of processes and procedures, contractors can demonstrate their commitment to risk mitigation. This proactive approach can result in reduced insurance premiums and a more favorable claims history over time.

Finding Affordable Insurance Providers

Finding affordable insurance providers is crucial for contractors looking to secure cost-effective general liability insurance

Leveraging Industry Associations

Industry associations can be a valuable resource for contractors looking for affordable general liability insurance. These associations often have partnerships with insurance providers, offering discounted rates to their members. By joining an industry association, contractors can access exclusive insurance options tailored to their specific needs.

Utilizing Online Platforms

Online platforms dedicated to connecting contractors with insurance providers can also be a useful tool in finding affordable general liability insurance. These platforms allow contractors to compare quotes from multiple insurance companies, ensuring they get the best possible deal. By leveraging online resources, contractors can easily navigate the insurance market and find cost-effective coverage.

Seeking Recommendations

Seeking recommendations from other contractors or industry professionals can also help in finding affordable insurance providers. Word of mouth referrals can provide valuable insights into the quality of service and pricing offered by different insurance companies. By tapping into their professional network, contractors can identify reliable insurance providers that offer competitive rates.

Utilizing Discounts and Bundling Options

Contractors can maximize savings on general liability insurance by taking advantage of discounts and bundling options offered by insurance providers. These strategies can help reduce overall insurance costs while maintaining adequate coverage.

Benefits of Bundling Multiple Insurance Policies

One effective way for contractors to save on general liability insurance is to bundle multiple insurance policies with the same provider. By consolidating policies such as general liability, commercial property, and commercial auto insurance, contractors can often receive a discount on their premiums.

Bundling not only streamlines the insurance process but also provides cost savings compared to purchasing individual policies from different providers.

Common Discounts Available for Contractors

- Multi-policy Discount: Insurance providers offer discounts to contractors who purchase multiple insurance policies from them. By bundling general liability insurance with other policies, contractors can qualify for reduced premiums.

- Claims-free Discount: Contractors who have a history of minimal or no insurance claims may be eligible for a claims-free discount. This discount rewards contractors for maintaining a safe work environment and minimizing risks.

- Professional Association Discount: Some insurance providers offer discounts to contractors who are members of professional associations related to their industry. Joining these associations can lead to savings on general liability insurance premiums.

- Renewal Discount: Insurance providers may offer discounts to contractors who renew their general liability insurance policies with them. By staying loyal to a provider and renewing policies regularly, contractors can benefit from lower premiums.

Customizing Insurance Coverage

When it comes to general liability insurance for contractors, customizing coverage is crucial to ensure adequate protection for their specific needs while also potentially saving money. By tailoring their insurance policies, contractors can address the unique risks they face in their line of work.

Optional Coverage Enhancements

- Adding coverage for completed operations: This extension covers any liabilities that may arise after a project is completed, offering protection for any potential issues that may surface down the line.

- Equipment breakdown coverage: This option safeguards contractors against financial losses due to equipment malfunctions or breakdowns, ensuring that they can continue their operations without major disruptions.

- Professional liability insurance: Also known as errors and omissions insurance, this coverage protects contractors from claims related to professional mistakes or negligence in their work.

Benefits of Customizing Coverage

- Cost-effectiveness: By tailoring their insurance coverage, contractors can avoid paying for unnecessary protections and focus on the specific risks they face, potentially reducing their insurance costs.

- Comprehensive protection: Customized coverage ensures that contractors have the necessary safeguards in place to address their unique liabilities, providing peace of mind in case of unexpected events.

- Flexibility: Contractors can adjust their coverage as their business evolves, adding or removing protections based on changing circumstances and needs.

Last Recap

In conclusion, mastering the art of finding cheap general liability insurance is crucial for contractors looking to protect their businesses without breaking the bank. By following the strategies Artikeld in this guide, contractors can confidently navigate the insurance market and secure the coverage they need at a price that fits their budget.

FAQ Resource

How can contractors determine the right coverage limits for their general liability insurance?

Contractors should assess the nature of their work, business size, and potential risks to determine the appropriate coverage limits that provide adequate protection without overspending.

Are there specific industry associations that contractors can turn to for help in finding affordable insurance options?

Yes, industry-specific associations often have partnerships with insurance providers, offering discounted rates to their members. Contractors should explore these associations for potential cost-saving opportunities.

What are some common risk management strategies that contractors can implement to lower insurance costs?

Contractors can focus on improving workplace safety, maintaining a clean claims history, and investing in training programs to reduce the likelihood of accidents or incidents that could lead to higher insurance premiums.