Delving into the world of Medibank Life Insurance Review: Is It Worth the Price?, readers are instantly captivated by a narrative that promises insight, analysis, and a fresh perspective on the value of this insurance option.

The ensuing paragraphs will shed light on coverage options, pricing details, customer feedback, and more, offering a comprehensive view of what Medibank Life Insurance has to offer.

Overview of Medibank Life Insurance

Medibank Life Insurance offers a range of coverage options to meet the diverse needs of individuals and families. Whether you are looking for basic coverage or more comprehensive protection, Medibank has options to suit your requirements.

Coverage Options Available

- Medibank Life Insurance provides coverage for death benefits, total and permanent disability, and terminal illness.

- Policyholders can choose the level of coverage that best fits their needs, with the option to add on extras such as funeral advancement benefit.

- There are also options for joint policies for couples or families looking for shared coverage.

Pricing Structure

- The pricing of Medibank Life Insurance policies is based on factors such as age, health status, and the level of coverage selected.

- Premiums can be paid fortnightly, monthly, or annually, offering flexibility to policyholders.

- Discounts may be available for policyholders who hold multiple insurance products with Medibank.

Reputation in the Market

- Medibank Life Insurance is a well-known and reputable provider in the Australian insurance market, with a history of providing reliable coverage and customer service.

- They have received positive feedback from customers for their efficient claims process and responsive support team.

- Medibank's strong presence in the market adds to their credibility as a trusted insurance provider.

Benefits of Medibank Life Insurance

When considering life insurance options, it's essential to weigh the benefits offered by each provider. Medibank Life Insurance stands out for several key advantages that set it apart from others in the market.Medibank offers a range of benefits that make their life insurance policies attractive to customers.

One of the primary advantages is the flexibility in coverage options, allowing policyholders to tailor their plan to suit their individual needs and budget. This customization ensures that customers are not paying for coverage they don't need, making it a cost-effective choice.

Comprehensive Coverage

Medibank Life Insurance provides comprehensive coverage that includes benefits such as lump-sum payments in the event of death, total and permanent disability cover, and terminal illness cover. This ensures that policyholders and their loved ones are financially protected in various scenarios, giving them peace of mind.

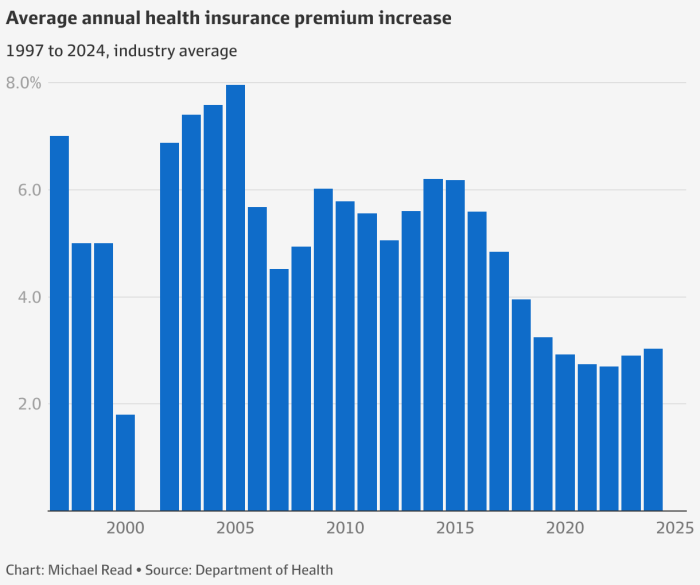

Competitive Premiums

Medibank offers competitive premiums compared to other life insurance providers in the market. This affordability makes it an attractive option for individuals and families looking to secure their financial future without breaking the bank. The value for money offered by Medibank's premiums makes it a popular choice among customers.

Additional Benefits

In addition to the standard coverage options, Medibank Life Insurance also provides unique features such as funeral advancement benefit, which helps cover funeral expenses upfront, and financial advice benefit, offering guidance on managing finances effectively. These additional benefits add extra value to the policy and demonstrate Medibank's commitment to customer satisfaction.Overall, Medibank Life Insurance stands out for its comprehensive coverage, competitive premiums, and additional benefits that make it a worthwhile investment for individuals and families seeking financial protection.

By choosing Medibank, customers can enjoy peace of mind knowing that their loved ones are financially secure in the face of unforeseen circumstances.

Customer Reviews and Feedback

When looking at customer reviews and feedback for Medibank Life Insurance, it's important to consider the overall satisfaction levels reported by policyholders. These reviews can provide valuable insights into the strengths and weaknesses of the insurance provider, helping potential customers make informed decisions.

Overall Satisfaction Levels

- Many customers have expressed satisfaction with the range of coverage options offered by Medibank Life Insurance, highlighting the flexibility and customization available.

- Positive feedback has also been given regarding the ease of the claims process and the responsiveness of customer service representatives.

Common Themes and Issues

- Some customers have raised concerns about the cost of premiums, with a few mentioning that they found the prices to be on the higher side compared to other insurance providers.

- There have been a few comments regarding delays in claim processing, which have led to frustration among policyholders waiting for reimbursement.

Standout Feedback

- One standout positive feedback mentioned by multiple customers is the comprehensive coverage provided by Medibank Life Insurance, giving them peace of mind knowing their loved ones are protected.

- On the flip side, a standout negative feedback highlighted by some reviewers is the lack of transparency in policy terms and conditions, leading to confusion and misunderstandings.

Claim Process and Payouts

When it comes to a life insurance policy, understanding the claim process and payouts is crucial for policyholders. Let's take a closer look at how Medibank Life Insurance handles claims and payouts.

Filing a Claim with Medibank Life Insurance

- Policyholders can initiate a claim by contacting Medibank Life Insurance either online, through their customer service hotline, or by visiting a branch.

- Upon notification of a claim, the insurer will provide the necessary claim forms and guide the policyholder through the required documentation.

- It is essential to submit all relevant documents promptly to expedite the claim processing.

Efficiency of Claim Processing

- Medibank Life Insurance is known for its efficient claim processing, with a focus on quick and hassle-free settlements for policyholders.

- The insurer aims to process claims promptly and keeps policyholders informed about the status of their claims throughout the process.

- Policyholders can expect a smooth and transparent claim processing experience with Medibank Life Insurance.

Payout Timelines and Experiences

- Typically, Medibank Life Insurance strives to ensure timely payouts to policyholders once a claim has been approved.

- Policyholders have reported positive experiences with the payout process, citing quick disbursement of funds to beneficiaries.

- The insurer prioritizes providing financial support to policyholders during challenging times, reflecting a commitment to customer satisfaction.

Comparison with Competitors

When considering life insurance options, it's important to compare different providers to find the best fit for your needs. Let's take a look at how Medibank Life Insurance stacks up against other leading companies in the industry.

Premium Rates and Coverage Options

When comparing Medibank Life Insurance with its competitors, one key factor to consider is the premium rates and coverage options offered. Medibank may excel in providing competitive rates for certain age groups or coverage amounts, while other companies might offer more comprehensive coverage options or additional benefits.

It's essential to carefully review the premium rates and coverage details of each provider to determine which one aligns best with your budget and needs.

Customer Service and Claim Process

Another important aspect to consider when comparing life insurance providers is the level of customer service and the efficiency of the claim process. Medibank Life Insurance may stand out for its responsive customer support and streamlined claim process, making it easier for policyholders to navigate during difficult times.

On the other hand, some competitors might offer more personalized customer service or faster claim payouts. Potential customers should weigh these factors to determine which provider offers the level of support they are looking for.

Financial Strength and Reputation

The financial strength and reputation of an insurance company are crucial considerations when selecting a provider. Medibank Life Insurance's stability and reputation in the industry may be a deciding factor for some customers, while others may prioritize the financial ratings and long-term stability of other competitors.

It's essential to research the financial strength and reputation of each insurance company to ensure that they will be able to fulfill their obligations in the long run.

Transparency and Trustworthiness

When it comes to choosing a life insurance provider, transparency and trustworthiness are key factors to consider. Customers want to know that the company they are entrusting with their financial security is open and honest about their policies and practices.Medibank, as a leading insurance provider, has a reputation for being transparent and trustworthy in its dealings with customers.

The company is known for providing clear and detailed policy information, making it easy for customers to understand what they are getting and what is covered under their life insurance plan.

Clear Policy Details

One of the ways Medibank demonstrates its commitment to transparency is by providing clear and detailed policy details to its customers. The company ensures that customers are fully informed about the coverage, exclusions, and terms of their life insurance policy, helping them make informed decisions about their financial future.

- Medibank offers comprehensive policy documents that Artikel the coverage and benefits of their life insurance plans.

- Customers can easily access information about premiums, deductibles, and any additional fees associated with their policy.

- The company also provides clear explanations of the claims process, ensuring that customers know what to expect in the event of a claim.

Customer Trust and Satisfaction

Medibank's commitment to transparency has earned the company trust and satisfaction from its customers. By being open and honest in their dealings, Medibank has built a reputation for reliability and integrity in the insurance industry.

- Customers appreciate Medibank's straightforward approach to policy information, which helps them feel confident in their decision to choose Medibank as their life insurance provider.

- The company's dedication to customer service and support further enhances its trustworthiness, as customers know they can rely on Medibank to assist them when they need it most.

- Positive customer reviews and feedback highlight the trust that customers place in Medibank, praising the company for its transparency and commitment to customer satisfaction.

Final Conclusion

In conclusion, the discussion on Medibank Life Insurance Review: Is It Worth the Price? leaves readers informed and empowered to make decisions about their insurance needs with clarity and confidence.

General Inquiries

What coverage options does Medibank Life Insurance offer?

Medibank Life Insurance provides various coverage options such as term life, total and permanent disability, and income protection insurance.

How efficient is Medibank Life Insurance's claim processing?

Medibank Life Insurance is known for its efficient claim processing, ensuring policyholders receive their payouts in a timely manner.

What sets Medibank Life Insurance apart from its competitors?

Medibank Life Insurance stands out with its comprehensive coverage, competitive pricing, and a strong reputation for customer service and satisfaction.